Compensation at a glance

To ensure their independence, BoD members only receive fixed compensation paid in cash and shares restricted for three years. The amount of compensation depends on the function within the BoD.

Summary of current compensation system of the BoD

|

Basic Compensation p.a. (in CHF) |

|

|

|

|

|

|

|

BoD Chair |

|

BoD Member |

|

in cash |

|

335,000 |

|

100,000 |

|

in restricted shares |

|

300,000 |

|

90,000 |

|

Total |

|

635,000 |

|

190,000 |

|

|

|

|

|

|

|

+ |

|

|

|

|

|

|

|

|

|

|

|

Additional Compensation p.a. (in CHF) |

|

|

|

|

|

|

|

Committee Chair |

|

Committee Member |

|

Audit Committee |

|

60,000 |

|

20,000 |

|

Nomination and Compensation committee |

|

60,000 |

|

20,000 |

Shareholding ownership guideline

The BoD members are required to own at least 500 dormakaba shares within three years of tenure.

Compensation of the BoD in financial year 2022/23

The compensation awarded to the BoD in financial year 2022/23 is within the limits approved by the shareholders at the AGM:

|

Compensation period |

|

Approved amount (CHF) |

|

Effective amount (CHF) |

|

AGM 2021 – AGM 2022 |

|

3,200,000 |

|

2,690,000 |

|

AGM 2022 – AGM 2023 |

|

3,200,000 |

|

To be determined* |

* The compensation period is not yet completed; a definitive assessment will be provided in the 2022/23 Compensation Report.

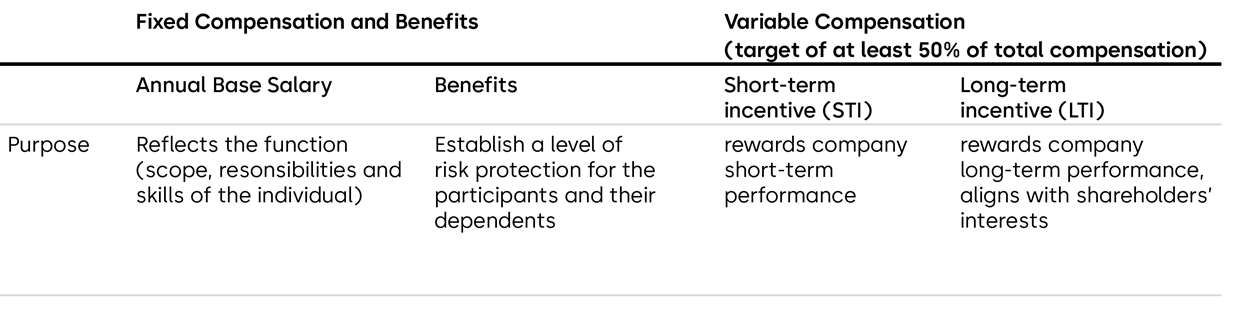

Summary of current compensation system of the EC

The compensation system applicable to the EC is designed to engage executives to implement the company’s strategy, to achieve the company’s short- and long-term business objectives, and to create sustainable shareholder value. It consists of the following elements:

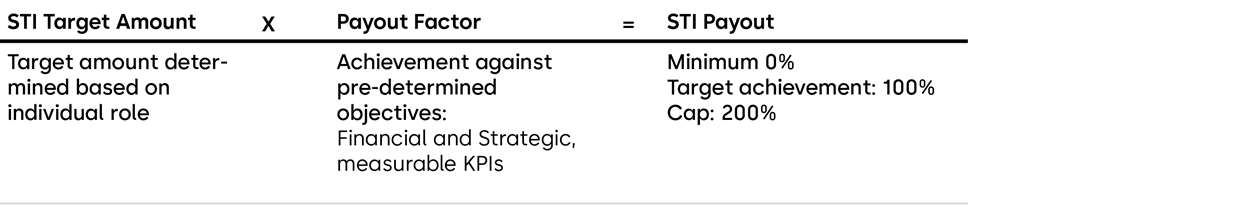

Variable compensation mechanisms

Short-term incentive mechanism

As from financial year 2022/23, the target-based design replaces the profit-sharing scheme.

Long-term incentive mechanism

Annual grant of Performance Share Units (PSU) based on a monetary amount, subject to a three-year vesting period.

Shareholding ownership guideline

The members of the EC are required to own a minimum multiple of their annual base salary in dormakaba shares within five years of tenure:

|

CEO |

|

300% of annual base salary |

|

EC member |

|

200% of annual base salary |

Compensation of the EC in financial year 2022/23

The compensation awarded to the EC in financial year 2022/23 is within the limits approved by the shareholders at the 2021 AGM:

|

Compensation period |

|

Approved amount (CHF) |

|

Effective amount (CHF) |

|

Financial year 2022/23 |

|

17,000,000 |

|

10,995,882 |

Performance in financial year 2022/23

dormakaba increased absolute net sales by 3.3% to CHF 2,848.8 million and posted strong organic growth of 8.4% for financial year 2022/23. Absolute adjusted EBITDA increased by 3.4% and amounted to CHF 384.8 million (previous year: CHF 372.3 million). The adjusted EBITDA margin was at 13.5% (previous year: 13.5%). Items affecting comparability were at CHF –118.5 million on EBIT (previous year: CHF –190.8 million (restated)) and mainly related to goodwill amortization and the implementation of the Shape4Growth strategy.

Net profit was CHF 88.5 million (previous year: CHF 38.8 million (restated)) and was impacted by a change in goodwill accounting (for more information, please see “Consolidated Financial Statements Chapter 5.1" as well as by expenses linked to strategy implementation which includes the conception and transformation program announced on 3 July 2023.

Compensation governance

- The NCC supports the BoD with matters related to the compensation of the BoD and of the EC.

- Shareholders approve the maximum compensation amounts of the BoD and of the EC. Further, they also express their opinion on the compensation system through a consultative vote on the Compensation Report.