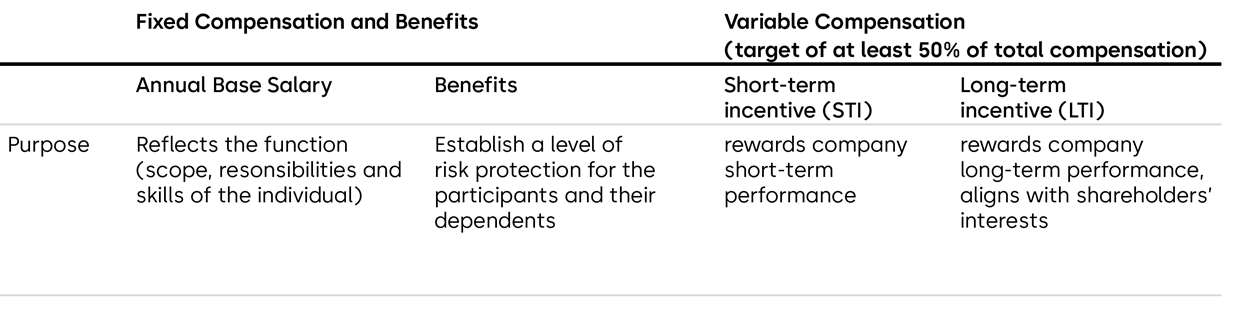

Compensation architecture for the EC

The compensation awarded to EC members is primarily driven by the success of the company. In addition to competitive fixed compensation, there is a performance-related component, which rewards for performance and allows EC members to participate in the company’s long-term value creation. The overall compensation consists of the following elements:

- Annual base salary;

- Benefits (such as retirement benefits);

- Short-term incentive;

- Long-term incentive (share-based compensation).

To ensure consistency across the organization, roles within the organization have been evaluated using the job grading methodology of Korn Ferry Hay Group. The grading system is the basis for compensation activities such as benchmarking and determination of compensation structure and levels. For comparative purposes, dormakaba refers to external compensation studies that are conducted regularly by Korn Ferry Hay Group in most countries. Overall, these studies include the compensation data of 2,500 technology and industrial companies, including listed and privately held competitors in the security sector that are comparable with dormakaba in terms of annual revenues, number of employees, and complexity in the relevant national or regional markets. Consequently, there is no predefined peer group of companies that is used globally. Rather, the benchmark companies vary from country to country based on the database of Korn Ferry Hay Group. For the CEO role, the following companies were included in the last benchmark analysis conducted in the financial year 2022/23 covering Swiss listed industrial companies of similar size in terms of market capitalization, revenue, and number of employees: Bucher Industries, Clariant, Forbo, Georg Fischer, Landis+Gyr, OC Oerlikon, SFS Group, SIG Combibloc, Stadler Rail, Sulzer, and Tecan.

As a principle, the compensation paid to the EC members must be based on the market median in the relevant national or regional market and must be within a range of –20% to +35% of this figure. The variable component of compensation (= short- and long-term incentives) is targeted to make for at least 50% of the total direct compensation (annual base salary, short-term incentive target and long-term incentive awarded). Thereof, the equity-based compensation opportunity (value of long-term variable compensation) is at least 30% of the total direct compensation.

1. Annual base salary

EC members receive an annual base salary for fulfilling their role. It is based on the following factors:

- Content, responsibilities, and complexity of the function;

- External market value of the respective role: amount paid for comparable positions in the industrial sector in the country where the member works;

- Individual profile in terms of skill set, experience, and seniority.

2. Benefits

As the EC is international in its nature, the members participate in the benefits plans available in their country of employment. Benefits mainly consist of retirement, insurance, and healthcare plans that are designed to provide a reasonable level of protection for the participants and their dependents in respect to the events of retirement, disability, death, and illness/accident. The EC members with a Swiss employment contract participate in the occupational pension plans offered to all employees in Switzerland, which consist of a basic pension fund and a supplementary plan for management positions. The benefits offered by the pension fund of dormakaba in Switzerland are in line with benefits provided by other Swiss multinational industrial companies.

EC members under foreign employment contracts are insured commensurately with market conditions and with their position. Each plan varies in line with the local competitive and legal environment and is, as a minimum, in accordance with the legal requirements of the respective country.

Further, EC members are also provided with certain executive perquisites, such as a company car or car allowance, representation allowance, and other benefits in kind according to competitive market practice in their country of employment.

3. Variable compensation

The variable compensation consists of a short-term incentive (STI) and a long-term incentive (LTI).

In the context of the strategic business review that was conducted in 2021 for the period 2022 to 2027, the NCC led a thorough review of the compensation program in financial year 2021/22 to ensure that it remains aligned with the strategic direction of the company, while continuing to drive performance, motivation, and behaviors that are aligned with the values of dormakaba. In line with the business strategy Shape4Growth and the related operating model, the current human capital context and the shareholder feedback received asking for more transparency, and a stronger pay-for-performance link, the NCC decided to make several changes to the STI and to the LTI programs. The changes have been implemented during the 2022/23 financial year and are described below.

3.1 Short-term incentive

The short-term incentive is a variable incentive defined annually as a cash payment. It is designed to reward the overall company performance and the EC members’ individual contribution to the dormakaba success over a one-year period, in line with the pay-for-performance compensation principle.

As of the financial year 2022/23, the STI model based on a predefined share of profit was replaced with a target-based system. Under the target-based system, each EC member including the CEO are allocated a target STI amount corresponding to the amount to be paid if all performance objectives are met (100% target achievement). The target STI amount is reviewed annually and expressed as an absolute amount. It is determined considering the organization level and external benchmark for a similar function in the relevant market, the positioning of the individual’s total direct compensation compared to that benchmark and the target pay mix for the position. The target STI amount for the CEO is CHF 825,000. The average target STI amount for other EC members is CHF 340,000.

The tables below illustrate the average payout range opportunity and the details on the STI performance metrics in terms of definition and weighting for the CEO and the other EC members:

STI Payout range opportunity in % of annual base salary

|

|

|

Minimum threshold |

|

100% Target achievement |

|

Maximum threshold |

|

CEO |

|

0% |

|

97% |

|

194% |

|

Other EC Members |

|

0% |

|

84% |

|

162% |

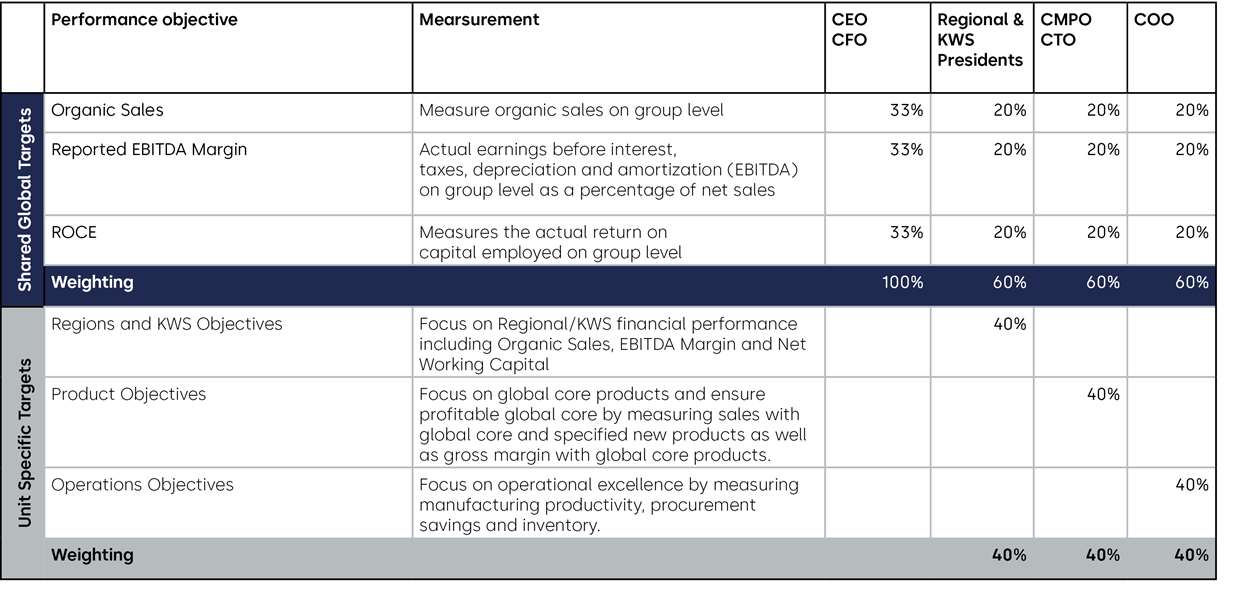

The plan is determined predominantly by the achievement of financial or otherwise strictly measurable goals at global, regional and product levels. Global financial goals are weighted 100% for the CEO and CFO and 60% for all other EC roles and include Organic Sales, EBITDA Margin and ROCE For the other EC roles, the remaining 40% are allocated to regional financial goals (Organic Sales, EBITDA Margin, Net Working Capital) for the Regional Presidents and to products for the CMPO and the CTO, while for the COO the remaining 40% relate to operational excellence goals.

Overview of performance objectives and respective weightings for FY 2022/23

At the beginning of the performance period, the NCC approves the minimum, target, and maximum achievement for the respective performance objectives. For performance below or at the minimum, 0% is paid out, whereby on-target performance (budget) is rewarded with a 100% payout. In case of overperformance, up to 200% can be achieved. Linear interpolation applies between the minimum threshold and the maximum threshold (cap). This payout curve applies to ROCE and most Unit Specific Targets.

To ensure a smooth transition from the former profit-sharing model, the payout curves for Organic Sales, EBITDA Margin, and selected Unit Specific Performance objectives are enhanced as described below.

For Organic Sales objectives at Global or Unit Specific level, the entry point for payout is the level of the previous year achievement and the 100% payout achievement reflects an ambitious budget.

For EBITDA Margin at Global and Unit Specific level as well as for selected Unit Specific performance objectives, a booster applies to the payout curve. With the booster, the payout for achievement on or above target is elevated by a factor of 1.5, allowing a maximum achievement of 300%. However, the overall STI payout cap remains at 200%.

For all performance objectives, the required achievement level is derived from the company’s strategic business plan and aligned with an ambitious budget for the respective financial year.

As this represents commercially sensitive information, no further details on the required achievement levels are disclosed. The calculation of the short-term incentive is based – just as the audited financial statements of the Group – on the actual figures recorded in the financial reporting system. Relevant performance achievements and the resulting STI payout factor for the financial year 2022/23 are reported in section 6. "Assessment of actual compensation paid to the EC in the financial year 2022/23".

The STI is paid in cash in the following financial year. In the case of termination of employment during the performance period, the payout of the STI may be reduced or forfeited depending on the conditions of such termination and subject to the applicable law.

3.2 Long-term incentive

The purpose of the long-term incentive is to provide the EC with an ownership interest in dormakaba and a participation in the long-term performance of the company and thus to align their interests to those of the shareholders.

Up to the 2022 grant, EC members are awarded performance share units at the beginning of the grant cycle (grant date) of dormakaba based on the following criteria:

- External benchmark: typical grant size of long-term incentive for a similar function in the relevant market and positioning of the individual’s total direct compensation compared to that benchmark. Total direct compensation includes fixed base salary plus short-term incentive plus allocation under the long-term incentive plan.

- Individual performance: measured against predefined priorities in the financial year prior to the grant, as documented within the performance management process. The long-term incentive is the only compensation program that takes into consideration the individual performance of the EC members. For each member, a list of individual strategic priorities is determined before the start of each financial year based on the mid-term plan of the Group, market/segment, or function. At the end of each financial year, the individual performance of the member is measured against those strategic priorities and will be considered for determining of the grant size of the long-term incentive in the following financial year.

- Strategic importance: impact of the EC member's projects on the company's long-term success.

- Retention: desire to retain the person to the company and to its overall long-term value creation by offering restricted shares and performance share units subject to a three-year vesting period.

The number of PSU granted in the reporting period is calculated by dividing the grant size (monetary amount) by the reference share price (volume weighted average share price over three months preceding the grant date). Pursuant to the Articles of Incorporation effective at the time of grant (September 2022), the fair value of the long-term incentive at grant was not allowed to exceed 150% of the individual annual base salary for the EC members (cap).

The PSUs are subject to a three-year performance-based vesting period. The award is designed to reward participants for the future performance of the earnings per share (EPS) and the relative TSR of the company over the three-year performance period. Both performance conditions are equally weighted at 50%. The vesting level may range from 0% to a maximum of 200% of the original number of units granted (maximum two shares for each performance share unit originally granted).

The relative TSR is measured relative to the SPI Industrials index: this index was selected as the performance benchmark because of the insufficient number of direct competitors of dormakaba that are publicly listed, which does not allow for a suitable customized peer group. Therefore, the SPI Industrials as an index of companies of comparable size listed on the SIX Swiss Exchange, was the most appropriate alternative.

The EPS growth target is to outperform weighted GDP growth by 2% points.

The vesting formula for both performance indicators is illustrated below; there is no vesting below the threshold levels of performance:

The vesting formula has been designed in line with market practice for Swiss publicly traded companies to combine pay for performance compensation principles and reach alignment with the long-term shareholder interest. It has both challenging targets and no excessive leverage. To reach the target, the company needs to outperform half of the peers in respect of relative TSR and needs to outperform GDP growth by 2% points on the EPS condition. While there is no payout below the threshold levels of performance, a partial payout is still possible for a performance between the threshold and the target. On the other side, an extraordinary performance is required to reach the cap of 200%.

Performance share units are usually awarded annually in September. In case of voluntary termination by the participant or if a participant is terminated for cause, performance share units are forfeited without any compensation. In case of termination without cause or retirement, performance share units are subject to a pro rata vesting at the regular vesting date. In case of disability, death, or change of control, performance share units are subject to an accelerated pro rata vesting based on a performance assessment by the BoD (see also Corporate Governance Report). The conditions for the award of performance share units are governed by the stock award plans of dormakaba.

Shares awarded in reporting periods 2022/23 and 2021/22 have come from dormakaba treasury.

The long-term incentive awards have been subject to claw-back and malus provisions since 2019. In certain circumstances, such as in the case of financial restatement due to material non-compliance with financial reporting requirements or fraudulent behavior or substantial willful misconduct, the BoD may decide to suspend the vesting or forfeit any granted long-term incentive award (malus provision) or to require the reimbursement of vested shares delivered under the long-term incentive (claw-back provision).

With the annual grant that is planned for September 2023, the LTI grant size will no longer be determined based on the criteria described above. Instead, the grant size will be set as a monetary amount considering the organization level and external benchmark for a similar function in the relevant market, the positioning of the individual’s total direct compensation compared to that benchmark and the target pay mix for the position.

Further, as from the annual grant 2023, the LTI compensation will include ESG related targets to reflect the increasing importance of sustainability. The ESG targets will cover both social and environmental topics that are addressed by our sustainability strategy to ensure all business and functions are represented with the ESG targets. ESG targets will be introduced in addition to the existing KPIs and will be weighted overall at 20%. Within the ESG target category, the following targets will be introduced: Carbon Emission Savings, Safety Improvement and Increased Sustainability Products Declarations.

Consequently, the weight of the other two KPIs will be reduced by 10% each, resulting in a weight of 40% for relative TSR and EPS growth respectively.

4. Employment contracts

The EC members are employed under employment contracts of unlimited duration that are subject to a notice period of up to twelve months. EC members are not contractually entitled to sign-on awards, termination payments, or any change of control provisions other than the accelerated vesting and/or unblocking of share awards mentioned above. The employment contracts of the EC members may include post-employement non-competition clauses for a duration of up to a maximum of two years. In cases where the company decides to activate the post-employement non-competition provisions, the compensation paid in connection with such non-competition provisions may not exceed the monthly base salary, or half of the total compensation, for a period of twelve months.

5. Shareholding ownership guideline

The EC members are required to own a minimum multiple of their annual base salary in dormakaba shares within five years of hire or promotion to the EC, as set out in the following table:

|

CEO |

|

300% of annual base salary |

|

EC member |

|

200% of annual base salary |

To calculate whether the minimum holding requirement is met, all vested shares are considered, regardless of whether they are restricted or not. However, unvested performance share units are excluded from the calculation. The NCC reviews compliance with the share ownership guideline on an annual basis. In the event of a substantial rise or drop in the share price, the BoD may, at its discretion, review the minimum ownership requirement.

6. Assessment of actual compensation paid to the EC in the financial year 2022/23

In comparison to the previous year, total direct compensation (TDC) of the EC has remained stable. There are several factors that impacted the level of actual compensation paid to the EC in the 2022/23 financial year, which are summarized below:

- Changes in EC composition: As part of the organizational simplification, the number of EC positions is reducing from nine to six. Andreas Haeberli, Chief Technology Officer, Alwin Berninger, Chief Marketing & Products Officer, Mathias Moertl, Chief Operations Officer, and Andy Jones, President Asia Pacific, are leaving dormakaba. Magín Guardiola joined the Executive Committee as of 1 April 2023 as Chief Marketing & Products Officer. Considering the transition in roles, a total of 12 EC members received compensation in the reporting year (2020/21: 11 EC members in total). Overall, the total compensation of CHF 11 million paid in the reporting year is comparable to the total compensation paid in previous year (2021/22: CHF 11.16 million).

- Compensation changes: For one EC member, the target base salary and STI was adjusted by 6% overall in local currency to bring compensation in line with market requirements. No other changes to EC compensation were made in the reporting period.

- STI payout: the STI payout formula is based on the achievement of pre-determined key performance objectives (as described under section 3.1) The STI payout of the CEO and EC members especially reflects the development of the Group's organic sales, EBITDA margin and ROCE, which are the main drivers of the STI payout. In line with the applicable rules, the Board decided to exceptionally consider the effects of the S4G transformation costs in the achievement of the Group EBITDA Margin and ROCE objective. Effects from amortization of goodwill are excluded from the relevant KPI in the STI calculation.

The payout amount is lower by 19% to the prior year payout reflecting the increased performance orientation and the ambitious target setting of the new STI scheme. In the reporting year, the STI payout of EC members is 56% of the annual base salary on average (previous year: 68%). For one EC member a pre-determined STI amount was paid out for the period of onboarding. - LTI grant in September 2022: to determine the individual grant size (nominal value), the allocation criteria in place for several years (as described under section 3.2) such as individual performance in the previous year, strategic importance of the projects under responsibility, position against benchmark and retention need were considered. The LTI grant at target is 21% lower compared to the previous reporting period, reflecting two new EC members with pro-rated grants.

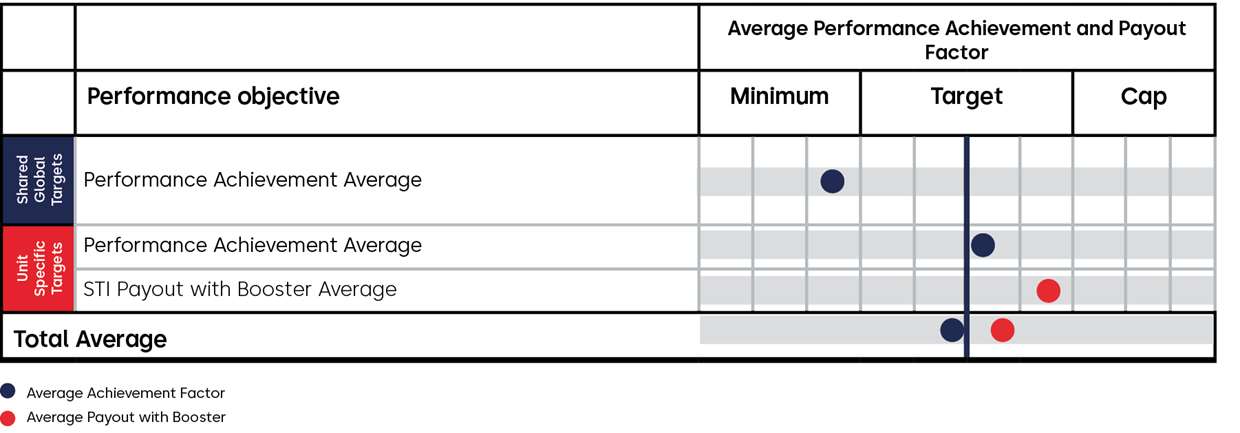

STI Performance

The STI performance achievement and payout range for Global and Unit Specific performance objectives (as described under section 3.1) is illustrated in the table below. As this represents commercially sensitive information, no further details on the required achievement levels are disclosed.

The table shows the range of performance objective achievement for shared performance objectives and Unit Specific objectives, as well as the STI payout factor range including the booster applied to selected Unit Specific targets. The principles for the application of the booster are described in section 3.1.

LTI Performance

The performance share units granted under the long-term incentive in September 2019 vested in September 2022 based on the EPS growth and the rTSR ranking over the three-year vesting period at a total vesting level of 30.88% based on the following performance factors:

The share price at vesting amounted to CHF 410.00 compared to CHF 697.50 at grant.

Realized Compensation Mix

Variable compensation forms a major part of total direct compensation (TDC). The percentage of overall compensation paid to the EC as variable compensation in the reporting year was 47% (excluding benefits and social security contributions) and represented a decrease compared to prior year's at 55%. Variable equity-based compensation (excluding EC members who joined dormakaba after the grant or who were no longer eligible for a grant) accounted for 27% of the TDC (previous year: 27%). This is in line with the compensation strategy and the pay for performance principles.

The table below represents the pay mix of the CEO and EC in relation to total direct compensation (excluding benefits and social security).

CEO*

** Annual Base Salary

EC*

** Annual Base Salary

Compensation paid compared to budget approved by shareholders

At the AGM 2021, the shareholders approved a maximum aggregate amount of CHF 17,000,000 for the EC for the financial year 2022/23. The compensation effectively awarded of CHF 10,995,882 is within the limit approved by the shareholders.

Loans and credits

As of 30 June 2023, in compliance with the Articles of Incorporation, no loans or credits were granted by dormakaba to current or former EC members, or parties closely related to them. Investments held by EC members or related persons (including conversion and option rights) – if any – are listed here.