Corporate Information

dormakaba Holding AG is the parent company of dormakaba Group, which was formed by the merger on 1 September 2015 of two previously unaffiliated enterprises: the family-owned German company Dorma Holding and the Swiss Kaba Group. Following the merger, dormakaba Holding AG owns 52.5% of dormakaba Holding GmbH + Co. KGaA, an intermediate holding company that comprises all the operating entities of the Group and is fully consolidated in the financial statements prepared by the parent company. Minority interests are shown separately as part of equity capital. dormakaba Holding AG’s consolidated financial statements are reported in Swiss francs (CHF) and for the financial year that runs from 1 July 2022 to 30 June 2023. They are prepared in accordance with Swiss GAAP FER, an internationally accepted accounting standard for small and medium-sized organizations and groups of organizations with a presence in Switzerland. dormakaba Holding AG is listed on the SIX Swiss Exchange and is headquartered in Rümlang (Zurich/Switzerland).

Beyond its obligations under Swiss GAAP FER, dormakaba Holding AG produces a Group Management Report that meets the requirements of the Swiss Code of Obligations (Schweizer Obligationenrecht, OR), particularly Art. 961c; of Section 315 of the German Commercial Code (Deutsches Handelsgesetzbuch, HGB); and of Standard 20 of the German Accounting Standards (Deutscher Rechnungslegungs Standard Nr. 20, DRS20).

Under § 290 of the Deutsches Handelsgesetzbuch (HGB, German Commercial Code), dormakaba Holding GmbH + Co KGaA is obliged to prepare consolidated financial statements, and under § 315 HGB it is obliged to prepare a Group Management Report. However, under § 292 HGB dormakaba Holding GmbH + Co KGaA is exempt from these obligations if consolidated financial statements and a Group Management Report are produced and published at the level of the parent company in Switzerland. dormakaba Holding GmbH + Co KGaA’s single-company financial statements were produced in accordance with the relevant provisions of HGB.

dormakaba Group (dormakaba) is one of the world’s top three companies providing smart, secure, and sustainable access solutions. Its comprehensive portfolio of strong brands offers customers a broad range of products, solutions, and services for secure access to premises, buildings, and rooms. With a clear portfolio segmentation, dormakaba concentrates on global core businesses such as Access Automation Solutions (door operators, sliding doors, and revolving doors), Access Control Solutions (connected devices and engineered solutions), Access Hardware Solutions (door closers, exit devices, and mechanical key systems), and services. The company is also a market leader for Key Systems (key blanks, key cutting machines, and automotive solutions such as transponder keys and programmers), as well as Movable Walls including acoustic movable partitions and horizontal and vertical partitioning systems.

dormakaba has a long tradition of innovation and engineering expertise. It strives to be an innovation leader that anticipates and fulfills customer needs through continuous technological advancement, creating state-of-the-art solutions that add value for customers and end users alike.

dormakaba is active in around 130 countries and is present in all relevant markets through production sites, distribution and service offices, and collaboration with local partners.

As a publicly listed company, dormakaba’s fundamental goal is to increase its long-term enterprise value across industry cycles and economic fluctuations. It is assisted in this by a strong Pool Shareholder Group that ensures the long-term orientation of its strategy. The company aims to create shareholder value while also furthering the interests of other stakeholders: most importantly its customers, as well as technology and distribution partners, employees, and associates.

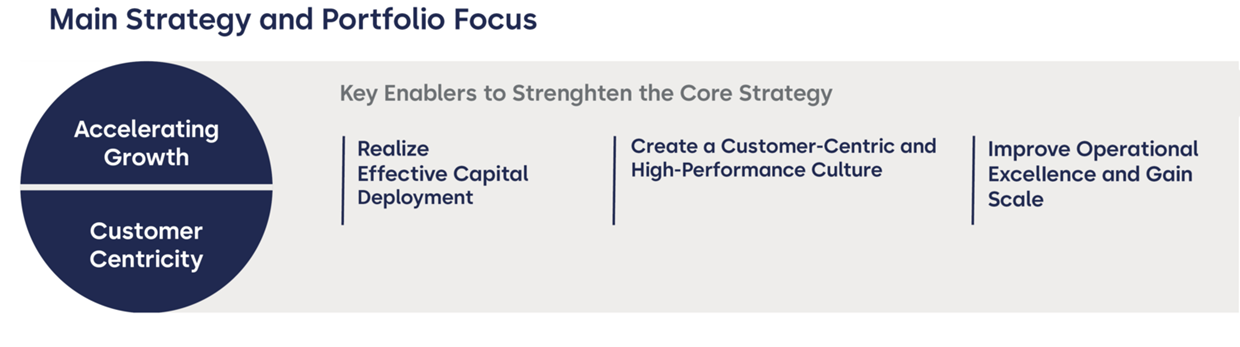

dormakaba's corporate strategy – Shape4Growth (S4G) – is about transforming the company, shaping it to its full potential, and accelerating profitable growth. It does so by building on five strategic pillars:

- Accelerating profitable growth: To strengthen commercial and innovation capabilities. The regional layers were dissolved: all Access Solutions business, starting 1 July 2023, is now the responsibility of the Chief Commercial Officer (CCO), with the company’s seven key markets (USA/Canada, Germany, Australia, Switzerland, UK/Ireland, China, and India) reporting directly to the CCO.

- Focus on customer centricity: The customer is at the heart of everything we do. As a result, dormakaba invests in tailoring services to the needs of our customers and specification capabilities, as well as reducing complexity in the operating model. Furthermore, the company puts sustainability at the center of its business model: Recognizing that sustainable operations are key to continued growth, Shape4Growth sets out an industry-leading sustainability framework with ambitious targets across three strategic areas: Planet, People, and Partnerships.

- Improve operational excellence and gain scale: dormakaba strives to continuously improve efficiency and effectiveness across the entire value chain. To support that, the company is driving a more global management of functions (e.g. HR, Finance, Operations) and driving economies of scale by bundling our activities across markets and functions. Furthermore, dormakaba is harmonizing its processes driven by global operating standards, optimized operating procedures, and investments in machines and technology to enable people and processes, as well as quality and efficiency.

- Realize effective capital deployment: Innovation is a key priority for dormakaba and the foundation that secures the company’s future success by clearly differentiating ourselves from competition and delivering on true customer needs. dormakaba will pursue innovation with an increased focus on technologies, products and markets that offer the highest growth and profit potential. In addition, we continue to diligently manage our portfolio of businesses, products, and locations to reduce complexity, gain scale, and enable attractive returns on capital employed.

- Customer-centric and high-performance culture: dormakaba plays to win – fostering a culture that focuses on the customer and on high performance. We act as one global dormakaba team with effective, cross-functional collaboration enabled by transparency and accountability, and supported by state-of-the-art processes and technology.

Shape4Growth includes a change in dormakaba’s operating model. The model builds on a more globalized management of our Operations and Product Development (Innovation) functions to secure efficiencies of scale and business synergies. This setup will be extended to globally managed Finance and HR functions.

The Executive Committee has been streamlined in line with the strategy and as of 1 July 2023 consists of the CEO, CFO, and COO plus a newly-appointed Chief Commercial Officer (CCO) and Chief Innovation Officer (CIO), along with the President Key & Wall Solutions and OEM.

The CCO will lead all Access Solutions market organizations. Those in the 5+2 core markets report directly, while the remaining markets are managed as three country clusters for greater efficiency. Customer excellence functions such as Strategic Marketing, Sales & OEM, Services, and the Product Management for Access Hardware Solutions and Access Automation Solutions are also under the CCO’s lead.

Product Development, along with the combined Access Control Solutions and EntriWorX product management organization, remain the responsibility of the CIO. This distinction reflects the different requirements of mature versus emerging businesses – more mature product segments in Access Hardware Solutions and Access Automation Solutions move closer to the core markets and customers, enabling disruptive innovation in less mature and more dynamic segments. A detailed description of the new operating model appears in the Notes to the Consolidated Financial Statements for financial year 2022/23.

Strategic leadership of dormakaba is exercised by the Board of Directors (BoD) of dormakaba Holding AG. The duties and responsibilities of the BoD are defined by the Swiss Code of Obligations, combined with the company’s Articles of Incorporation and Organizational Regulations. The BoD delegates responsibility for day-to-day management of the business to the Chief Executive Officer (CEO), supported by the Executive Committee (EC). The powers and functions of the EC are set out in the Organizational Regulations. Further details of the internal management system are provided in the Corporate Governance Report 2022/23.

The principles governing compensation for the BoD and EC are set out in the Articles of Incorporation. These include: the basic principles of compensation for the BoD (Article 23); the basic principles of compensation for the EC (Article 24); a binding vote on compensation at the General Meeting of Shareholders (Article 22); the maximum additional amount of compensation for new EC members (Article 25); agreements with members of the Board of Directors and the Executive Committee, and notice periods for the members of the Executive Committee (Article 26); and their credits and loans (Article 28).

The Compensation Report, which provides further details on the compensation system and on compensation paid out in the financial year 2022/23, is available here.

Responding to the needs and expectations of society, customers, and employees, dormakaba has made a long-term commitment to fostering sustainable development along its entire value chain, recognizing its economic, environmental, and social responsibilities to current and future generations.

The company’s sustainability framework is based on a rigorous materiality assessment: Monitoring global trends and engaging with key stakeholders, dormakaba has identified ten material topics that are most relevant for stakeholders and where the company has the highest potential impact. The framework outlines sustainability standards and measures for the period from 2021 to 2027, grouping topics according to three broad categories: People, Planet, and Partnerships.

The dormakaba Sustainability Report 2022/2023, prepared in accordance with Global Reporting Initiative (GRI) standards, contains detailed information on the company’s sustainability framework, measures, and progress. The information published on dormakaba’s sustainable economic activities is in line with the EU’s Taxonomy Regulation. dormakaba is taking active steps to comply with forthcoming regulations on non-financial reporting, including the Swiss ordinance on disclosure based on the indirect counter-proposal to the Responsible Business Initiative, and the recommendations of the Task Force on Climate Related Financial Disclosures. The Sustainability Report is supplemented by annually issued reports on related matters, such as the Modern Slavery Statement, the Communication on Progress to the UN Global Compact, and in the submission to the Carbon Disclosure Project.

The key to dormakaba’s sustainable profitable growth is its strength in innovation. As of 1 July 2023, dormakaba will be putting even more focus on its innovative strengths: The newly established role of Chief Innovation Officer will lead all global engineering capabilities and be responsible for dormakaba’s innovation strategy, including the platform and connectivity initiatives through the EntriWorX ecosystem. The company continuously develops new products, solutions, and services, supported by a substantial annual investment in R&D.

In the last two financial years, dormakaba has submitted applications for more than 100 technical patent families. Employees around the world contribute to the Group’s innovation and product development, increasingly using data-driven ecosystems to create solutions that will satisfy future needs of customers and markets. The company has also set up a range of technology partnerships to realize the potential of its offerings in vertical markets such as airports, healthcare, lodging, and multi-housing.

The new operating model introduced under the Shape4Growth strategy means that all R&D and product development efforts are now organized as one global function. This has led to a range of initiatives to rationalize dormakaba’s product offerings onto common hardware and software platforms, reducing time-to-market while increasing efficiency in product development. The company continues to enhance the value of digital transformation through sophisticated service offerings, including the first comprehensive support package covering the full life cycle of its products: not just planning and installation, but continuous, digitally provided day-to-day services. Further, dormakaba is building on its newly introduced security operating model by continuously improving of our management processes in accordance with international standards for information security such as ISO 27001.

Continued investment in digitalization and related product innovation has positioned the company well to provide its customers with effective solutions to their fast-evolving needs for safe, secure, and sustainable buildings. The adoption of seamless, touchless access and mobile solutions, originally prompted by the Covid-19 pandemic, has accelerated further, opening opportunities for dormakaba in attractive vertical markets such as healthcare and multi-housing.

dormakaba continues to embed sustainability in the core of its product development. Several sustainability innovations have been brought to the market, including an energy efficiency calculator and a novel sensor system for automatic doors to optimize each building’s energy consumption.

This financial year has seen a wide array of new product launches around the globe including the following business areas: Digital Services, Access Control, Access Automation, Access Hardware Solutions together with Key Systems and Movable Walls.

In digital services, dormakaba has launched a range of linked products based on the 9240 EntriWorX Unit, which coordinates and controls communication between devices and the Exos access management system. The EntriWorX Setup App distributes “digital twin” data from a door planned in EntriWorX Planner to commission the physical door for its intended function. The EntriWorX Door Insights web app gives customers a self-service option to monitor installations and receive help in resolving minor issues. EntriWorX Supported Service allows more major problems to be resolved remotely by dormakaba experts, and provides on-site technicians with all the information required. dormakaba Lyazon integrates with third-party systems, giving fluid control over access points using the customer’s preferred platform. Meanwhile, Exos with KONE People Flow offers combined software-based elevator and access control.

The Saffire EVO Lock, another new launch, connects directly through Wi-Fi to provide an easy-to-use, secure, and flexible access control solution, using mobile BLE credentials, RFID Cards/Fobs or PIN codes for access to residential units or common doors.

New access automation products include the Argus V60, a space-saving speed gate with proprietary tailgating sensory technology; it allows installation in the smallest spaces and has won international security and design awards. The RC Touch touchscreen remote control allows simultaneous or individual control of up to ten access-control units equipped with the new Connector One expansion unit, which provides a LAN interface to integrate doors and security gates into modern OPC UA standard smart building systems.

New access hardware includes the ES PROLINE range of drive systems for automatic sliding doors, with modular features allowing use in almost all applications. This system has been launched in central European markets and has a global launch scheduled for August 2023. In the institutional market, the EHD9000 extra heavy-duty cast-iron rack-and-pinion closer competes directly with the leading North American market closer product.

Flexy represents a semi-industrial solution for key systems executing automatically different key working phases including milling, dimple drilling, and bitting operations. The machine is driven directly by 3D CAD information. It is completely reconfigurable and customizable based on specific needs of different industries and users. In the professional automotive locksmithing market, dormakaba’s cloud cloning solutions can duplicate 99% of the transponders for around 99% of the cloneable vehicle keys in global circulation.

Finally, Skyfold Prisma is the first and only vertical folding acoustic glass partition; its beta installation is scheduled for the second quarter of the 2023/24 financial year. Skyfold Prisma ensures confidentiality for meetings, classes, and collaboration while providing unencumbered sightlines and natural illumination.

In the financial year 2022/23 dormakaba operated in a business environment that was characterized by various factors. On the positive side, demand in the commercial construction area remained at a high level in all regions and the company closed the year with a good order intake and backlog in all regions. This enabled dormakaba to increase organic growth to 8.3% in the financial year 2022/23.

The macroeconomic environment showed a recovery in supply chains with shipping costs and suppliers’ delivery times going back to pre-Covid levels in late 2022. As a consequence of the recovery in the supply chain, some customers and distributor destocked their inventories during 2022/23, which impacted demand in Europe in the first half of 2022/23 and in the Americas in the second half. Meanwhile, the risk for further disruptions and resulting insecurities remained high due to the ongoing war in Ukraine. Demand in China recovered compared to the prior year but was still below expectations due to Covid-19 restrictions and shutdowns. Shortages in labor and a highly competitive employment situation in the US caused delays especially in the Project and Services business. Inflationary pressure remained high causing central banks especially, in the US and Europe to increase interest rates frequently. dormakaba successfully continued to increase sales prices to offset inflation, driving sequential improvement of profitability in all sales regions in the second half of the financial year 2022/23 despite the first half being historically stronger.

The impacts of the war in Ukraine and further accelerated inflation continued to slow down GDP growth development. In the first and second quarters of the financial year 2022/23, GDP in the G20 countries recorded quarter-on-quarter growth of 1.3% and 0.3%, respectively (OECD, 2022). In the third quarter of the financial year 2022/23, GDP growth slightly recovered, at 0.9% with the biggest quarter-on-quarter changes occurring in China, Brazil, and India (OECD, 2023).

Detailed information on the business performance and the average number of full-time equivalent employees in the financial year 2022/23 can be found in the Financial Performance section of this Group Management Report and in the Consolidated Financial Statements for the financial year 2022/23.

dormakaba has defined a set of strategic non-financial performance indicators for the current strategy cycle. These were introduced during the Capital Markets Day in November 2021 and are continuously tracked, although not used for operational control. The main non-financial performance indicators are the following:

Customers and products

Customer satisfaction and product quality are crucial for dormakaba as a brand that stands for its high-quality products. Customer satisfaction is assessed through regular dialog as well as through local surveys.

Net Promoter Score (NPS)

This is a well-known metric that measures customer loyalty and satisfaction through one simple KPI: the likelihood of a customer recommending dormakaba. The NPS is collected on an annual basis through surveys covering all customer groups and product clusters in core markets. The results are monitored by management to identify any changes necessary to drive improvement in customer satisfaction.

Innovation Power

This metric captures how successful innovations are in relevant markets, and therefore how R&D efforts contribute to the overall success of the Group. As a KPI, it has become part of the Group incentive program, helping to ensure that innovation processes are well aligned to customer needs.

Human resources

Two indicators, Employee Engagement and Diversity & Inclusion, help to track dormakaba’s success in its transformation towards a customer-centric and performance-oriented work culture that fosters accountability and ownership and enables professional growth.

dormakaba measures its Employee Engagement Index through periodic global surveys, the most recent of which was conducted in February 2023. Over 12,000 employees participated, responding to 32 questions on topics such as Me & My Work Environment, My Manager, Engagement, Shape4Growth, Inclusion, and Wellbeing. The results showed an Employee Engagement Index of 71% and an Employee Enablement Index of 74%.

dormakaba is committed to diversity in employment and has established concrete targets to improve the gender balance of management teams, including 33% of managers to be women by 2027, and 25% women in succession planning for senior management positions by the same date. There is further information on the targets and initiatives in the Sustainability Report.

Compliance and human rights

As a matter of course, dormakaba complies with all applicable laws and regulations at local, national, and international levels. Its internal company directives, based on a binding Group-wide Code of Conduct, apply globally and cover internal processes as well as relations with external partners, including customers, authorities, and suppliers. dormakaba has developed a range of measures and processes to prevent abuses and ensure that responsibilities are met; these measures and processes are continuously reviewed and refined. The Code of Conduct is available, in several languages, to all employees on the Group Intranet and to external stakeholders on the dormakaba website. All dormakaba employees participate in mandatory Code of Conduct training sessions.

The Code of Conduct and the Supplier Code of Conduct confirm dormakaba’s commitment to respecting human rights. The Group’s Human Rights Due Diligence (HRDD) framework and material topics are further described in its Statement of Commitment on Human Rights, which aligns with international standards, including the UN Guiding Principles on Business and Human Rights, and which will be revised to reflect the forthcoming requirements under the German Supply Chain Due Diligence Act.

Based on the Human Rights-related risks and impacts identified, dormakaba will continue to develop prevention and mitigation measures integrated into company operations, training programs, policies, and management systems. Human rights-related risks identification and mitigation are a central part of supplier due diligence as well. In the financial year 2022/23, a key focus has been to further assess the salient issues of child labor through the continuation of a supply chain traceability project in collaboration with suppliers. In addition, the Statement of Commitment on Human Rights has been revised to reflect new requirements coming from the German Supply Chain Due Diligence Act, which will apply to dormakaba as of 2024. There is further information on human rights in the Sustainability Report 2022/23.

Environment

As a manufacturer, dormakaba inevitably consumes resources and generates waste and emissions; environmental issues are therefore highly relevant along the Group’s entire value chain. In September 2021/22, dormakaba adopted its Environment Policy Directive, which defines its fundamental requirements and regulations for environmental performance. The directive has since been updated with new product development standards to reflect dormakaba’s commitment to a circular economy. A detailed overview of the company’s sustainability work and key benchmarks, including greenhouse gas emissions, energy consumption, water consumption, and waste management, is available in the Sustainability Report 2022/23.

Supply chain

dormakaba maintains a comprehensive, globally consistent procurement policy, based on detailed analysis of its own needs and rigorous assessment of current and potential suppliers, supported where necessary by on-site quality audits.

The dormakaba Supplier Code of Conduct outlines minimum requirements relating to human rights, fair working conditions, environmental responsibility, and business ethics, among other criteria. Supply chain risk assessment is based on seven families of indicators: energy and emissions; effluents and waste; occupational health and safety; materials; training and education; freedom of association; and human rights. dormakaba assesses suppliers’ sustainability performance in collaboration with EcoVadis, the world’s most trusted business sustainability ratings provider, and requires improvement plans where assessment results are unsatisfactory.

Further information is available in the Supplier Sustainable Development chapter of the Sustainability Report 2022/23.