Resource Use and Circular Economy

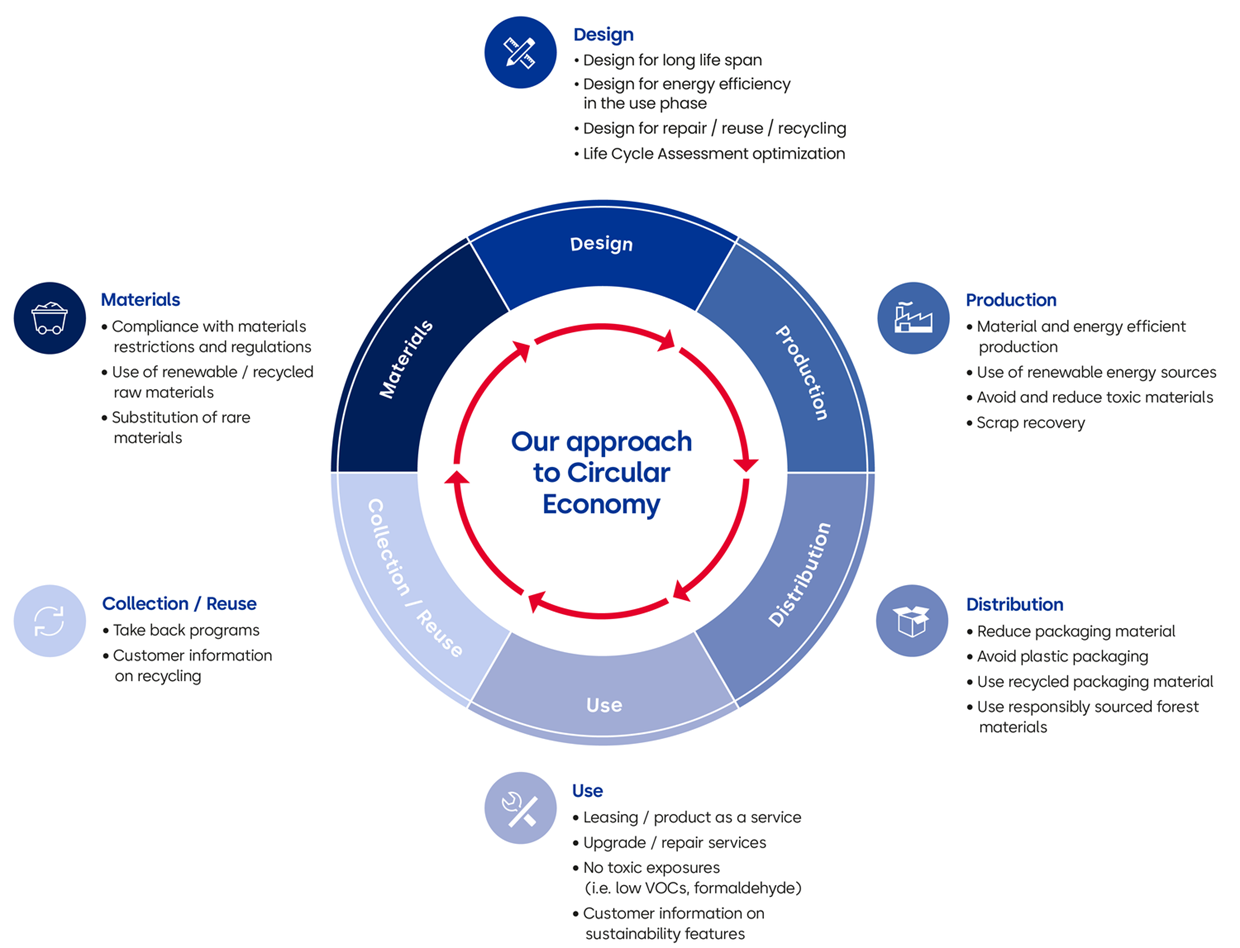

We are accelerating circular solutions to develop material- and energy-efficient, high-quality products that reduce our customers’ environmental impact and meet the needs of a sustainable built environment.

Our approach

We live in and depend on an interconnected world, with complex environmental, social, economic, and cultural systems. Damaging one element may have an unexpected impact elsewhere. We recognize the limits of our planet and that we must act more sustainably in order to meet increasing social and economic demands. As a leading manufacturer, dormakaba is committed to incorporating the latest product life cycle approaches and environmental technologies to continuously advance our product development and improve our own and our customers’ sustainability performance. This provides new opportunities for our design and manufacturing processes and addresses the demand for eco-friendly solutions.

Our Product Sustainability department, part of Global Innovations, oversees product sustainability globally, providing resources, and expertise, while shaping a state-of-the-art development environment. This also includes developing Environmental Product Declarations (EPD) and other sustainability-related product declarations and certifications, incorporating sustainability criteria into all product development-related processes, and developing guidelines.

Our global Environment Directive regulates environmental management in manufacturing practices as well as regulates mandatory requirements on product circularity and eco-design, including energy efficiency and minimum recycled content benchmarks for each product family. The Environment Directive promotes the utilization of secondary materials and reused components in dormakaba products, while emphasizing design principles that ensure durability, recyclability, easy disassembly and adaptability. Additionally, it outlines specific preferences for responsibly sourced, nature-based materials, such as paper, cardboard, or wood paneling. Furthermore, in FY 24/25 we developed a group-wide Material Compliance Directive to establish roles and responsibilities across functions as well as the minimal requirements needed to ensure our products meet legal requirements on hazardous substances and responsible sourcing. The directive will be rolled out across the organization in the financial year.

The dormakaba sustainability commitment and life cycle approach are also integrated into our Product Design Manual and Corporate Design Packaging Guideline.

Targets related to resource use and circular economy

All of our circular economy targets were set voluntarily, based on internal stakeholder discussions and industry benchmarks. Further information on our target-setting process is found in the General Information chapter.

|

Targets |

|

Relevance of targets |

|

Design phase |

|

|

|

All new product developments and optimizations are covered by our circularity approach by 2027 |

|

Circular product design (including design for durability, dismantling, reparability, recyclability) and EcoDesign (including recycled content requirements) |

|

Resource inflows |

|

|

|

100% of paper, wood and carton stems from responsible forestry sources as accepted by the US Green Building Council (baseline 223 tons in FY 20/21) |

|

Increase of circular material use rate; sustainable sourcing and use of renewable resources |

|

Zero fossil fuel-based plastic used in packaging by 2027 |

|

Sustainable sourcing and use of renewable resources |

|

Resource outflows |

|

|

|

We offer extended producer responsibility take-back schemes for all products and packaging in top ten sales countries by 2027 |

|

Increase of circular material use rate; minimization of primary raw material |

|

Zero waste to landfill in our operations by 2027 (baseline 3,443 tons in FY 20/21) |

|

Shifting waste treatment to circular options (recycling, reuse, recovery) |

Product design with the circular approach

With an average lifespan of 40–50 years, buildings should ideally be constructed in a way that allows the embedded materials and natural resources to be used efficiently. As a result, product design remains a core focus of our sustainability strategy, with an emphasis on energy consumption and carbon emissions during the product’s use phase, waste management, and recyclability at its end of life.

With the implementation of the EcoDesign Specification Template, all new product developments and optimizations follow our circularity approach. The template, which is part of our Adaptive Innovation Methodology (AIM) Directive, ensures sustainability criteria are met for every process related to product development across the company. It covers energy use, materials selection, longevity/durability, repairability, adaptability, and disassembly, and also sets minimum requirements for recycled content and packaging design.

In FY 23/24, we worked together with Key & Wall Solutions teams to include additional requirements based on their unique product portfolios as well. This included providing recycled content data for materials like gypsum and glass wool, used only in Wall Solutions, as well as energy values for key cutting machines and Wall Solutions.

Product Scoring Model

To enhance and assess the environmental performance of our products, we have developed a comprehensive product sustainability scoring model which will be implemented in the next financial year. This model evaluates products across several key areas, including:

- Documentation & Transparency: Each product is assessed based on the availability of environmental and health-related documentation, such as EPDs or relevant local certifications.

- Carbon Footprint: Scoring is determined by comparing the product’s lifetime carbon footprint versus similar product types.

- Circularity: Products are scored based on circular economy criteria like longevity or repairability.

- Material Compliance: Scoring is based on an evaluation of hazardous material composition, with a focus on lead content, distinguishing between lead-containing and lead-free components.

- Sustainable Production: The model also considers production site certifications and practices, including the use of green electricity or biogas, as well as adherence to ISO standards.

Resource Inflows – Materials

Among the most important raw materials we use for our products, there are metals such as steel, brass, aluminum, nickel silver, and zinc, as well as gypsum board, glass, and plastics. Other important materials are wood, paper, and cardboard, which are made from renewable resources.

Material use (in %)

Raw material use (in %)

We respect the universal human right to safe and clean drinking water and sanitation. As part of our obligation to respect this right, we assess the level of water scarcity in areas where we operate. The latest analysis revealed that approximately 44% of our sites have the potential for high to extreme water stress. The water stress analysis is based on the two databases Aqueduct Water Risk Atlas by the World Resources Institute and AQUASTAT by the Food and Agriculture Organization. KPIs on water withdrawals, consumption and discharge can be found in our ESG Performance Table.

Recycled content

As mentioned, our Environment Directive sets a minimum amount of recycled content for several materials. We also work with suppliers to help us obtain certifications on the recycled content of our products, as these certifications help our customers achieve green building standards. We have such certifications for 39 products, spanning three main product groups: door closers (19), locks (8), and exit devices (12). The average recycled content for each product group is 59%, 40%, and 45%, respectively. Since the primary extraction of metals from ore and the subsequent refining processes are resource-intensive, one key focus is to increase the use of metals with a high level of recycled content, which will contribute to decreasing Scope 3 carbon emissions.

For more information about product declarations and certifications, see our Marketing and Labeling activities

During FY 24/25 we made progress with our suppliers to better understand our recycled content baseline for brass, aluminum and steel. Out of 290 suppliers in scope, we collected 95 declarations on pre- and post-consumer recycled content. Most of the suppliers needed personal clarification meetings or had to double-check the requested information with their sub-suppliers. We have found that only 33% out of these suppliers provide goods that reach our internal minimum thresholds of total recycling content. In FY 25/26, we will evaluate how to increase these percentages or shift our spend to those suppliers that are able to meet our minimum thresholds.

Transparency on substances of concern

As part of our ongoing efforts to ensure Material Compliance and chemical transparency, we have continued to enhance our processes for identifying and managing hazardous substances in our products.

Building on our long-standing collaboration with Assent in the Americas region, where we have established an automated compliance and supplier engagement process, we successfully introduced the same approach in Germany during the reporting year. This system enables structured data collection on material composition and supports proactive supplier engagement to assess the presence of any substances of concern.

As part of our Environmental Product Declarations (EPDs), we conduct material compliance risk assessments for all new or renewed EPDs. These identify Substances of Concern based on material types and, when available, are supported by supplier documentation. This step strengthens the overall robustness of our EPD process and ensures that potential chemical risks are considered early in the product life cycle.

We also carried out a focused review of frequently used plastic materials across our portfolio to evaluate potential risks related to per- and polyfluoroalkyl substances (PFAS), polycyclic aromatic hydrocarbons (PAHs), softeners (e.g., phthalates), and flame retardants. Whenever possible, these evaluations were substantiated with supplier-provided information.

To improve internal awareness and regulatory preparedness, we conducted training sessions for key stakeholders on the new EU Battery Regulation. This training content is being converted into a dedicated e-Learning to support consistent knowledge across the organization.

These activities reflect our commitment to regulatory compliance, product safety, and increased material transparency across our global supply chain.

Environmentally friendly packaging

We primarily use paper, cardboard, wood, and plastic for packaging, and for each of these material types we have set targets to move towards more sustainable choices.

For example, by 2027 we want to use zero fossil fuel-based plastic in our packaging (baseline 223 tons in FY 20/21). In FY 24/25, we continued to explore sustainable alternatives to plastic packaging, though significant progress remains limited. Surveys conducted at plants in Ennepetal (Germany), Singapore, and Suzhou (China) helped identify current plastic use, and initial research into alternative materials and suppliers was undertaken. However, the evaluation process revealed considerable challenges. Sustainable materials were often difficult to source, suppliers lacked the technical maturity to meet industrial standards, and many alternatives fell short of dormakaba’s stringent product and sustainability requirements. Additionally, higher costs and limited scalability further constrained viable options.

To address these obstacles, during FY 25/26 we will focus on more targeted actions. These include engaging external consultants for expert insights, expanding the supplier network to include niche innovators, and co-developing solutions that meet performance standards. Continued internal testing, streamlined evaluation processes, and deeper involvement from manufacturing plants will be key to driving progress. The company is also assessing whether recycled plastics could serve as an interim solution, pending their environmental impact evaluation relative to bio-based options.

We have also set a target to source 100% of paper, wood and carton from responsible forestry certification schemes that are accepted by the US Green Building Council, like Sustainable Forestry Initiative (SFI), American Tree Farm System (ATFS), and the Programme for the Endorsement of Forest Certification (PEFC). To support this, we work with suppliers to encourage certification under responsible forestry schemes, organizing meetings with third-party representatives to raise awareness and address certification questions. By the end of FY 24/25 we have transitioned around 30% of our paper packaging, over 50% of our cardboard and 15% of wood packaging. Additionally, all packaging for products manufactured in Suzhou (China) and Singapore are now sourced from forests with these certifications.

Resource Outflows

Products

We manufacture Access Automation Solutions (door operators, sliding and revolving doors), Access Control Solutions (connected devices and engineered solutions), Access Hardware Solutions (door closers, exit devices, mechanical key systems), Key Systems (key blanks, key cutting machines, and automotive solutions) and Movable Walls (acoustic partitions and partitioning systems).

Repairability

We prioritize the repairability and adaptability of our products, ensuring they can be easily upgraded to meet new technological standards. This approach contributes to maximizing the reference service life of our products while also enabling simple disassembly at the end of their lifecycle. To achieve this, we incorporate key design principles such as modular concepts, the use of standardized components, and ensuring upgradability and backward compatibility. Additionally, we focus on using detachable connections, reusable fasteners, and avoiding adhesive bonds or metallic continuity, all of which enhance the overall serviceability of our products. Through these measures, we guarantee that all our products remain fully serviceable throughout their lifecycle.

Additionally, as part of our efforts to improve repairability, we created initial demounting instructions for selected products. These instructions are designed to support service technicians and users in identifying and replacing individual components, thereby extending product lifespan and reducing waste.

Durability

To ensure long-term user satisfaction, our products are designed to surpass the standard reference service life, as defined by applicable ISO/EN norms. We implement several strategies to extend this lifespan, including analyzing and reinforcing weak points from previous product versions, allowing for the disassembly of key parts for maintenance or repair without damage, and ensuring the availability of replacement parts. Additionally, we offer extended warranties and provide information to help consumers maintain and extend the product’s life, including guidance on necessary inspection and maintenance intervals.

Expected durability

|

Product type |

|

dormakaba products |

|

Industry average |

|

Automatic and Manual Sliding Doors |

|

1,125,000 cycles |

|

1,000,000 cycles* |

|

Card Readers & Peripherals |

|

13.9 years |

|

7 – 10 years*** |

|

Door Closers |

|

740,000 cycles |

|

500,000 cycles** |

|

Electrified Door Hardware |

|

20 years |

|

10 years** |

|

Electronic Hotel Locks |

|

10 years |

|

10 years** |

|

Electronic Locks, Cylinders, Keys and Cores |

|

10.9 years |

|

10 years** |

|

Emergency Exit Systems |

|

350,000 cycles |

|

200,000 cycles** |

|

Glass Hardware |

|

21.1 years |

|

no industry average available |

|

Lever handles |

|

200,000 cycles |

|

100,000 cycles** |

|

Mechanical Locks, Cylinders, Keys and Cores |

|

370,000 cycles |

|

100,000 cycles** |

|

Movable Partitions |

|

62.5 years |

|

no industry average available |

|

Revolving Doors and Interlocks |

|

1,450,000 cycles |

|

1,000,000 cycles* |

|

Safe Locks |

|

7 years |

|

no industry average available |

|

Sensor Barriers/Speed Gates |

|

16.3 years |

|

no industry average available |

|

Sliding Door Operators |

|

940,000 cycles |

|

1,000,000 cycles* |

|

Swing Door Operators |

|

10 years |

|

10 years** |

|

Terminals |

|

10 years |

|

7 – 10 years*** |

|

Turnstiles |

|

15 years |

|

no industry average available |

* According to EN 16005

** According to ARGE-EPDs

*** According to EU Green Public Procurement criteria

Recyclability

By focusing on design for disassembly and using recyclable components, we enable our customers — as well as any companies responsible for building demolition or renovation — to properly recycle our products at the end of their life cycle. Recyclability rates are available in all of our EPDs. A summary of recyclability rates averaged across product families is found below.

|

Product family |

|

Average recyclability rates (excl. packaging) in % |

|

Automatic and Manual Sliding Doors |

|

63 |

|

Card Readers & Peripherals |

|

48 |

|

Door Closers |

|

97 |

|

Electrified Door Hardware |

|

90 |

|

Electronic Hotel Locks |

|

95 |

|

Electronic Locks, Cylinders, Keys and Cores |

|

91 |

|

Emergency Exit Systems |

|

94 |

|

Glass Hardware |

|

97 |

|

Lever handles |

|

95 |

|

Mechanical Locks, Cylinders, Keys and Cores |

|

96 |

|

Movable Partitions |

|

29 |

|

Revolving Doors and Interlocks |

|

50 |

|

Safe Locks |

|

63 |

|

Sensor Barriers/Speed Gates |

|

72 |

|

Sliding Door Operators |

|

90 |

|

Swing Door Operators |

|

65 |

|

Terminals |

|

47 |

|

Turnstiles |

|

63 |

Waste management

We aim to send zero waste to landfill in our operations by 2027 (baseline 3,443 tons in FY 20/21) in order to decrease our disposal rate. To reach this, 33 manufacturing sites are developing sustainable waste management roadmaps. Since the launch of the program, ten sites have received or are receiving tailored support, including on-site audits and waste optimization plans in collaboration with external experts from Beyondly. In FY 24/25, plants in Canada and Peru joined the program. Local management is trained and encouraged to share best practices. The specific action plans include waste stream characterization, segregation to find waste value, diverting key materials from landfill waste, and identifying potential local partners and users of waste streams.

We monitor our waste by treatment method and waste type. At 68% by weight, the largest proportion of non-hazardous waste is scrap metal, followed by other commercial and industrial waste (15%), wood, paper, cardboard, and chemicals among others. In FY 24/25, approximately 88% of the waste stream was recycled, reused or recovered.

Hazardous waste management is especially crucial in electroplating, surface finishing, and painting processes. We work to minimize the volume and toxicity of waste from these operations through continuous improvement projects. Our filter systems prevent hazardous substances from being released externally, and toxic waste is disposed of as special waste. Certified disposal companies are commissioned to dispose of industrial waste and chemicals, and to recycle materials wherever possible.

Non-hazardous waste by type

(in metric tons)

Hazardous waste by type

(in metric tons)

Dyersville’s journey to zero waste to landfill

At dormakaba’s Modernfold production site in Dyersville (USA), a persistent waste challenge has sparked an innovative solution. In FY 23/24, the site accounted for 44% of our global landfill waste — and over 60% of this was from production scraps from cutting gypsum board, a key component of its operable wall systems. After a three-year search, the team partnered with MDK ZeroLandfill in November 2024, enabling the recycling of gypsum into agricultural soil conditioner.

Since then, Dyersville has recycled over 5 million kilograms of gypsum, reducing landfill waste by 34% versus the previous financial year. We expect to cut landfill waste by 66% and divert nearly 850 tons annually. This success is a major step toward dormakaba’s global goal of zero waste to landfill by 2027. Dyersville is one of the manufacturing sites which was working with our external partner Beyondly to develop waste reduction roadmaps focused on reuse, recycling, and local partnerships.

Take-back programs

dormakaba products have typical lifetimes of 10–20 years, with some products having 40-year lifetimes. Even after these long lifetimes, some materials and components could be reused, repaired, or reintroduced as raw materials back into the manufacturing cycle. This is the aim behind our target to offer extended producer responsibility take-back schemes for all products and packaging in the top ten sales countries by 2027.

Over the past two years, we worked with a strategic partner called Resourcify to assess the feasibility of take-back programs in three pilot markets, which were considered the most mature in terms of circularity-related infrastructure: Austria, Germany, and the UK. This included a thorough review of local legislative requirements and current practices, as well as workshops with employees from logistics, quality management, sales, and product development to identify opportunities and barriers. We focused on best-selling products in each country, aiming to identify those that could create the volume needed to support an effective and economically viable take-back system.

In Austria, for example, we evaluated the potential for collecting and reusing cylinders and came across several challenges. First, we are often too far from the end-user and installation point to track where our products end up, which means we have little leverage and control over their disposal. We surveyed our distribution partners and found interest in product sustainability, but little appetite for collaboration in take-back programs. The waste value of mechanical cylinders is well known, and partners prefer to return them directly to local recyclers as an additional revenue stream. The additional transportation costs of sending the cylinders to us also served as an obstacle, even in cases where these costs would be absorbed by us. We could not compete with the recycling companies. The pilot in the UK, which focused on hotel locks, faced the same obstacles.

We have concluded that cylinders and other mechanical products are already well integrated into recycling waste streams as part of standard demolition processes. Creating a dedicated take-back loop for such products would not bring additional ecological or financial benefits nor further support a circular economy. As a result, we have decided not to move forward with dedicated take-back programs for mechanical products at this time. However, we continue to take full responsibility for our products at end-of-life. We already have well-established waste management and recycling processes in place, and whenever products are sent back to our factories, in the UK or in Austria for example, we ensure that these get recycled properly.

The pilot in Germany, however, has seen greater success — primarily because we not only focused on mechanical but also electromechanical parts. Due to supply chain scarcity for some of these components, dismantling and reuse have become more economically viable. We have successfully implemented a return and reuse system there. Read more about this in the story below.

In the upcoming financial year, we will reevaluate our approach to product take-back schemes more broadly.

Return and reuse program in Germany

At our European Logistics Center (ELC) in Germany, we launched a return and reuse program as part of our ongoing sustainability efforts. Products that are dismounted by our service technicians or are sent back by customers from all over Europe are no longer automatically directed to disposal. Instead, they are systematically returned, dismantled, and checked for reusable components.

Non-critical parts that are in perfect technical condition are either used as spare parts or, if needed, sent to our production site in Ennepetal (Germany) to be reintegrated into the manufacturing process. This not only reduces procurement and production costs but also contributes directly to the conservation of natural resources. In the FY 24/25, around 31,000 components have been reintegrated into the cycle.