Climate Change

We are demonstrating leadership in the transition to a low-carbon economy within the industry and beyond.

Our approach

The emission of greenhouse gases (GHG), which are generated through the burning of fossil fuels, is one of today’s biggest challenges. Every business, government, and individual has a role to play in meeting the goals of the Paris Agreement. Facilitating the transition to a low-carbon economy is therefore high on our agenda.

The sustainability governance, risk management framework, integration in the companyʼs overall strategy Shape4Growth and decision-making processes described in the Governance and Sustainability Risk Management sections of this Report (see: General Information) extends to climate-related matters, risks and opportunities, metrics and target setting.

We understand the risks posed by climate change, and we are taking action to reduce our energy consumption and related emissions to move towards a low-carbon economy. We see two ways to make a significant contribution to facilitating the transition to a low-carbon economy: one, by directly ensuring the efficiency of our own operations; two, by indirectly helping to reduce the carbon footprint of the buildings and projects to which we supply our products. The measures we have derived from our scenario analysis approach incorporate both the financial side of our business and our operational strategy. The idea is to integrate climate-related and risk management initiatives into all our solutions and processes, as this will allow us to become more resilient as a company in the long term — and help our customers become more sustainable, too.

We use the latest scientific knowledge to guide a sound management approach, and our emission reduction targets have been validated by the Science Based Targets initiative (SBTi). Both our operational (Scope 1+2) and value chain (Scope 3) targets were approved by the SBTi in 2021.

Our energy consumption and GHG emission reduction program is part of our global Environment Directive. Furthermore, our Environment, Health & Safety, and Sustainable Products Expert Groups as well as local management teams and QHSE staff are developing and implementing initiatives to achieve the related targets.

One such target is the establishment of energy management systems at our manufacturing sites that account for 85% of all on-site energy consumption. As of 30 June 2025, 100% of our sites in scope (18 sites) have established energy management systems versus 61% in the previous financial year, which is a huge leap forward in aligning energy management based on a global ISO 50001-aligned approach.

This is an important milestone, given the dependencies we have on energy during our production processes. Many components used to create our products are manufactured in-house through processes including melting, aluminum and zinc die casting, machining, purchased parts processing, and final assembly. The aforementioned processes also require controlled, HVAC-conditioned space for process control, labor efficiency, and maintenance of a healthy working environment. As a result, we are focusing many of our climate-related initiatives on energy efficiency.

Stronger environmental standards for energy and emissions

In FY 24/25 we updated the Environment Directive to further strengthen our approach to energy use and emissions reduction across operations. Key updates include new energy-related requirements for new and expanding facilities, such as the mandatory assessment of solar PV readiness, use of green refrigerants and biogas where feasible, and structural provisions for energy-efficient technologies. All sites must now opt for green electricity if locally available. Enhanced energy monitoring is required for large facilities consuming over 500 MWh/year, ensuring improved tracking of Significant Energy Users. In addition, fleet management standards have been included to reduce fuel consumption and carbon emissions. These measures reinforce dormakaba’s efforts to minimize environmental impact while supporting the transition to a low-carbon future.

Climate-related risks and opportunities and resilience of dormakaba’s strategy

dormakaba is dedicated to integrating climate-related risks and opportunities into our company-wide strategic decision-making. This approach not only helps us to maintain our competitive edge and prepare for the future but also signals our commitment to meeting the needs and expectations of stakeholders and society. In short, doing the right thing for the planet benefits everyone.

As part of our broader risk management framework, which enables us to mitigate and eliminate risks across all aspects of our business, we have identified significant risks and opportunities, not least those related to climate change (see Sustainability Risk Management section).

Climate scenario analysis

A turning point in our efforts to reduce our carbon footprint came when we conducted an in-depth scenario analysis of our business with a focus on climate change mitigation. We mapped this analysis on to business decisions, financial plans and capital allocation as a means of identifying climate-related risks and feasible opportunities.

We can break down the scenario analysis into three primary activities:

- Identifying current and future risks and opportunities relating to the transition to more environmentally friendly material flows (in alignment with our risk assessment framework)

- Calculating the financial impact that these risks and opportunities could have and how they may influence dormakaba’s financial planning and operational strategy

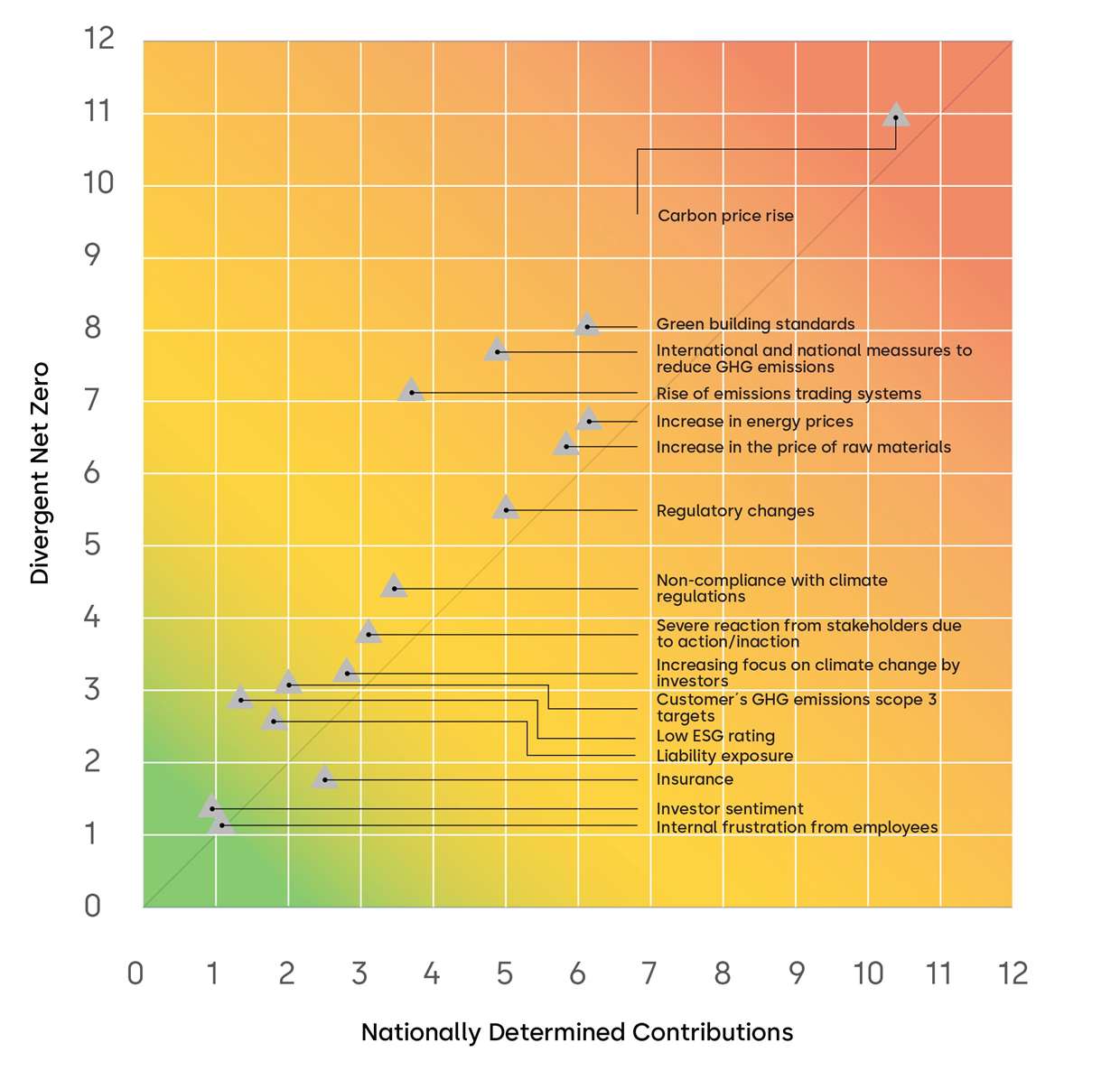

- Evaluating the main transition risks and opportunities based on two distinct emissions scenarios across three time frames: short-term (0–1 years), medium-term (1–3 years) and long-term (3–15 years). The long-term time frame currently deviates from our broader risk management process, which formally looks at short-term and medium-term time frames. The two scenarios mentioned are based on frameworks from the Network of Central Banks and Supervisors for Greening the Financial System (NGFS):

- The Nationally Determined Contributions (NDCs) assumes that the conditional NDC commitments are implemented in full and that the energy and emissions targets will be reached in every country in 2025 and again in 2030, leading to a global warming rate of approx. 2.6°C.

- Divergent Net Zero assumes that the world will reach net-zero emissions by around 2050, albeit with higher costs due to divergent policies introduced across sectors, leading to a quicker phase-out of oil. Under this scenario, global warming will be limited to 1.5°C, in accordance with the Paris Agreement.

Transition risks and opportunities

As the world shifts towards a low-carbon, climate-friendly future, our business will need to overcome a range of societal and economic challenges. With this in mind, we conducted a literature review as well as several interviews and workshops with colleagues from our risk, strategy, operations and sustainability teams to identify key climate transition risks and opportunities. After drawing up a long-list of related risks, we settled on six transition risk clusters and assessed their individual impacts:

- Financial and investment: The transition to a low-carbon economy will require significant investment in research and development. Having sufficient access to financing and investment will likely accelerate the pace of this transition (with reduced financing having the opposite effect).

- Markets: Volatile energy and raw material prices projected based on both emissions scenarios are expected to have a significant impact on dormakaba’s suppliers and our own production costs.

- Technology: As well as presenting various opportunities for our business, technological advancements may enhance cost efficiency, performance, sustainability, energy efficiency and reliability, leading to greater competition in our industry.

- Legal: dormakaba may face legal challenges from regulators or other parties who claim that our operations do not comply fully with environmental laws and regulations.

- Reputation: Our reputation may suffer in the public eye (customers, investors, other stakeholders, etc.) if we fail to address climate change or meet our climate-related targets. This can lead to a loss of trust, credibility and financial buoyancy.

- Regulatory: Some policy measures or uncertainty regarding how or when to implement them could have a negative impact on production costs and potentially affect our market growth.

Sixteen transition risks and three opportunities were identified in these six risk clusters:

Overall transition risks rating

Long-term risks tend to have a higher significance and likelihood that they will occur. This is especially the case under the Divergent Net Zero scenario, where climate-related challenges are expected to be more severe. The exception is the “insurance” risk, which refers to disaster and catastrophe insurance premiums; they may be lower in a world where global warming has increased by only 1.5°C.

To calculate the overall risk ratings across various time horizons, we applied the following weightings: 50% for short-term risks (0–1 years), 30% for medium-term risks (1–3 years), and 20% for long-term risks (3–15 years). These weightings reflect a lower level of certainty when it comes to long-term projections.

Of the 16 risks identified, six come with a high impact and likelihood of occurrence in either or both climate scenarios. The most significant is rising carbon prices due to national and international carbon schemes. This, combined with the increasing cost of globally sourced goods, could lead both to higher operating costs and a fall in demand due to escalating product prices.

This is especially important to consider when looking at future mergers and acquisitions and the procurement of machinery (due to their energy consumption).

By the end of 2025, the annual carbon costs for our own Scope 1+2 emissions could range from USD 5 to 50 million (this would be lower under the NDC scenario and higher under the Divergent Net Zero scenario). According to our estimates, this could increase to anywhere from USD 12 to 89 million per annum by 2030.

Another factor to consider is the unquestionable increase in the price of raw materials. For instance, European enterprises importing aluminum and steel from outside the EU will face higher costs due to the Carbon Border Adjustment Mechanism (CBAM) and associated Scope 3 emissions.

Most significant transition risks and impacts

|

Risk title |

|

Description |

|

Business element impact |

|

Financial impact |

|

Financial impact pathway |

|

Potential mitigation method |

|

Carbon price increase |

|

Higher price of carbon through national and international schemes |

|

Operations, markets |

|

Cost |

|

Higher operating costs, reduced demand due to rising product prices |

|

Shadow carbon tax of USD 40, i.e., the cost of tCO 2 e emissions |

|

Rise of emissions trading systems |

|

Higher price of carbon or taxes if cap is exceeded |

|

Operations, markets |

|

Cost, capital investment |

|

Potential increase in cost of legal compliance |

|

Investment in greener technologies to reduce emissions ahead of rising carbon prices, alignment of GHG with Paris Agreement and commitment to SBTi |

|

International and national measures to reduce GHG emissions |

|

Regulation requiring significant equipment modifications, operational changes or the purchase of emissions credits to reduce GHG emissions from operations |

|

Operations, markets, legal and compliance |

|

Capital investment, preparations, cost |

|

Increased capital costs, higher compliance, operating and remediation costs |

|

Investment in greener technologies, reduction of ODS in refrigeration and air conditioning systems, reduction of fossil fuels in production process, efficiency-boosting measures |

|

Green building standards |

|

Changes to building codes and standards for more energy efficiency and sustainability could impact demand for dormakaba’s products, particularly those related to access control and security in green buildings. |

|

Product, market |

|

Revenue, investment |

|

Failure to adapt to new standards could result in reputational and financial damage |

|

Invest in research and development and engage with policy makers to ensure products are compliant |

|

Increase in energy prices |

|

Energy prices impacted by price of oil, gas and renewable energies |

|

Markets |

|

Revenue, operating costs |

|

Higher operating costs, reduced demand due to rising product prices |

|

Diversification of energy supply sources, negotiation of long-term contracts, productivity improvements, cost reduction |

|

Increase in the price of raw materials |

|

More volatility in supply and demand as well as wider commodity price resulting in higher prices for raw materials |

|

Markets |

|

Revenue, operating costs |

|

Higher operating costs, reduced demand due to rising product prices |

|

Diversification of sources for the supply of key raw materials, negotiation of long-term contracts with minimum purchase obligations, productivity improvements, cost reduction, diversification of energy sources |

Most significant transition opportunities and impacts

|

Type |

|

Risk title |

|

Description |

|

Business element impacted |

|

Financial impact |

|

Financial impact pathway |

|

Potential leveraging method |

|

Market |

|

More demand for products aiding climate adaptation and resilience |

|

Heat pumps and other low carbon technologies will likely be in higher demand |

|

Markets, sales |

|

Revenue |

|

Increased revenue from higher sales of new products |

|

Investment in product development and plans for stronger market growth |

|

Regulation |

|

Commitment to development of public policies to reduce GHG emissions and the transition to a low-carbon economy |

|

Improving regulatory certainty can help to guide investment decisions and drive growth in demand for energy-efficient products |

|

Legal and compliance, markets |

|

Revenue |

|

New regulations may increase demand for low-carbon technology |

|

Investment in product development to meet anticipated future demand |

|

Technology |

|

Reduction of GHG emissions through product enhancements |

|

Harnessing breakthrough technologies to enhance products and reduce company/downstream GHG emissions |

|

Product, assets, markets |

|

Capital, financing, revenue |

|

Capital investment in technology is required, increased revenue from higher sales, lower fines/taxes for high GHG emissions |

|

Evaluation of breakthrough technologies and product-specific LCA, target for % of innovation pipeline to undergo sustainability assessment |

Physical risks and impacts

Physical climate-related risks have the potential to affect various industries, ecosystems, and quality of life. This is why effective risk management, adaptation and mitigation measures must be taken now at both the economic and political levels to build resilience and reduce our vulnerability to these climate-related hazards.

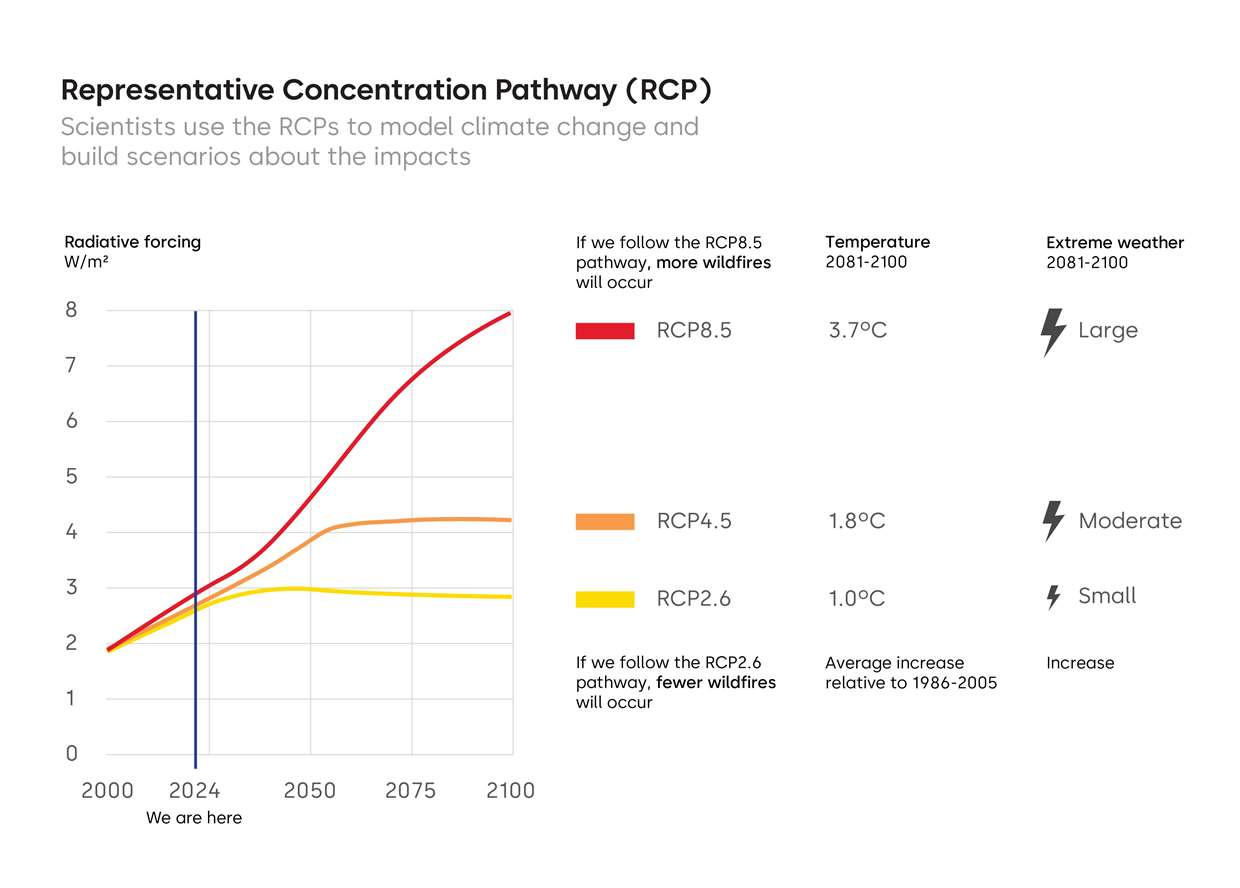

Against this backdrop, we have adopted a data-driven approach to identify and analyze those physical climate-related risks likely to have the greatest impact on our global operations. We also used this approach to map how these risks may evolve under different trajectories according to three emissions scenarios, known as Representative Concentration Pathways (RCPs).

We evaluated the following risk types: climate change exposure; coastal flooding hazard; cooling degree days; drought hazard; extra-tropical cyclone hazard; flood hazard; heat stress; heating degree days; sea level rise; severe storm hazard; tropical storm and cyclone hazard; and water stress and wildfire hazard.

We assessed all of these risks types based on Verisk Maplecroft’s risk indices while incorporating various validated climate change projections. For each of our business locations, we drew up a profile to gauge site-specific exposure to acute risks and chronic hazards and included a materiality threshold that was specific to that location. The risk scores are presented on a relative scale, allowing for simple comparisons between locations and time frames. This allows us to make informed decisions regarding investing in and allocating resources to each site, and streamlines the strategic decision-making process thanks to the awareness of risks.

While some hazards have a low risk of exposure for dormakaba, such as coastal flood and landslide, others, such as severe storm, heating degree days, heat stress, drought and water stress, have a higher risk across multiple locations. The table below shows the types of climate risks applying to our material sites:

Most significant physical risks

|

Climate risk |

|

Description |

|

Business element & region impact |

|

Financial impact |

|

Financial impact pathway |

|

Potential mitigation method |

|

Cooling degree days |

|

Processes affected by high temperatures lead to reduced productivity or trigger emergency responses, or else affect staff working conditions |

|

Operations, Logistics, Sales, Assets, Finance; Africa and Asia |

|

Capital expenditure, operating costs, revenue |

|

Higher capital costs for adaptation measures, damage repairs/need for replacement equipment or materials, higher operating costs, reduced production |

|

Increase in cooling capacity, relocation of operations away from high-risk areas, implementation of emergency planning and OHS policies in line with best practices |

|

Heating degree days |

|

Processes affected by low temperatures lead to reduced productivity or trigger emergency responses, or else affect staff working conditions |

|

Operations, Logistics, Assets, Sales, Finance; most regions |

|

Capital expenditure, operating costs, revenue |

|

Higher capital costs for adaptation measures, damage repairs/need for replacement equipment or materials, higher operating costs, reduced production |

|

Investment in technology, heating from renewable energy sources, relocation of operations away from high-risk areas, implementation of emergency planning and OHS policies in line with best practices |

|

Severe storm |

|

Severe storms impact operations and infrastructure, including: damage to buildings; supply chain disruption due to impact on transport of materials; impact on employee homes and ability to commute to work; disruption to energy and water supply. |

|

Operations, Logistics, Sales, Assets, Finance; primarily in Asia |

|

Capital expenditure, operating costs, revenue |

|

Higher capital costs for adaptation measures, damage repairs/need for replacement equipment or materials, higher operating costs, reduced production |

|

Investment in storm defense measures and technology, including secondary containment systems with dewatering capability; productivity gains, relocation of operations away from extreme-risk locations, implementation of emergency planning in line with best practice, diversification of transport providers. |

|

Drought |

|

Reduced access to water impacts productivity |

|

Operations, Sales, Assets; Middle East & South America |

|

Operating costs, revenue |

|

Higher costs due to lack of access to water, reduced revenue from lower sales |

|

Investment in technology, reduction of freshwater intake, relocation of operations away from areas affected by high water stress, implementation of contingency measures such as early-warning systems when water is low. |

|

Heatwaves/ heat stress |

|

Processes affected by high temperatures lead to reduced productivity or trigger emergency responses, or else affect staff working conditions |

|

Operations, Logistics, Sales, Assets, Finance; Middle East, Asia & South America |

|

Capital expenditure, operating costs, revenue |

|

Higher capital costs for adaptation measures, damage repairs/need for replacement equipment or materials, higher operating costs, reduced production |

|

Increase in cooling capacity, including expanding and optimizing central recooling plants and optimization of cooling water flows capable of avoiding production outages; relocation of operations away from high-risk areas, implementation of emergency planning and OHS policies in line with best practices, diversification of transport providers |

|

Water stress |

|

Reduced access to water affects productivity |

|

Operations, Sales, Assets; Middle East, Asia, South America, Southern Europe |

|

Operating costs, revenue |

|

Higher costs due to lack of access to water, reduced revenue from lower sales |

|

Investment in technology, reduction of freshwater intake, relocation of operations away from areas affected by high water stress, implementation of contingency measures such as early-warning systems when water is low. |

|

Extreme rainfall |

|

Heavy rainfall causes water to collect on stock tank roofs, which may cause the roof to sink and compromise the tanks’ containment ability, leading to reduced productivity, essential emergency responses, rising river water levels, which may damage facilities or cause transport disruption |

|

Operations, Sales, Assets, Finance; Asia & Western Europe |

|

Capital expenditure, operating costs, revenue |

|

Higher capital costs for adaptation measures, damage repairs/need for replacement equipment or materials, higher operating costs, reduced production |

|

Investment in heavy rainfall defense measures, technology, productivity gains, relocation of operations away from extreme risk locations, diversification of transport providers |

We have completed an initial assessment quantifying the potential financial impacts of the identified physical climate-related risks over the medium term (2030) and long term (2050), on a consolidated basis. This analysis assumed a total loss of revenue and assets for locations classified as high or extreme risk.

We assessed all sites in the scope of our environmental reporting across our operational regions, and followed this up with a closer analysis of 33 of our most important locations. These locations were designated as “material sites,” with the categorization being awarded based on factors such as net sales, number of employees, and tangible asset value based on a relative ranking of all other locations.

Based on these results, we have developed site-specific scorecards and benchmarks for each site, geography, and business entity. These will be shared with the respective local management teams in early FY 25/26, along with recommended mitigation measures tailored to each risk type. Material sites under extreme or high risk are considered high-priority sites for climate adaptation. These sites will be tasked with defining and implementing climate adaptation actions within the next two years, while other sites will be given additional time to develop and implement their plans.

While this initial quantification has been valuable in prioritising locations for further action, the assumption of a total loss of revenue or assets represents an unlikely worst-case scenario. As a result, we are not yet able to report the ESRS-required metric for the proportion of revenue and assets at material physical risk. The below table gives an indication of the risk types and the corresponding countries of operation where the risk could materialize.

|

Risk type |

|

Climate risk |

|

Countries potentially impacted |

|

Acute |

|

Drought hazard |

|

Bulgaria, Spain |

|

|

Severe storm |

|

Australia, China, India, Italy, Malaysia, Singapore, Taiwan, USA |

|

|

|

Tropical storm and cyclone hazard |

|

China, Taiwan |

|

|

|

Wildfire hazard |

|

USA |

|

|

Chronic |

|

Cooling degree days |

|

Australia, Canada, China, India, Malaysia, Singapore, Spain, Taiwan, USA |

|

|

Heat stress |

|

Australia, China, India, Malaysia, Singapore, Taiwan, USA |

|

|

|

Heating degree days |

|

Australia, Bulgaria, Canada, France, Germany, Italy, Netherlands, Poland, Spain, Switzerland, USA |

|

|

|

Water stress |

|

Australia, China, Germany, India, Singapore, Spain, USA |

Resilience of our company strategy

We conducted an assessment to consider the various effects of climate change on our facilities. The reason was to gain insight into the physical risk profile (whether acute or chronic) of our operations, identify both vulnerabilities and opportunities, and make strategic decisions to boost our resilience across all aspects of the business. The assessment was based on climate model projections presented by the following three Representative Concentration Pathways (RCPs):

- RCP2.6: Aggressive mitigation assumes global annual GHG emissions will peak between 2010–2020, with emissions declining substantially after this point.

- RCP4.5: Strong mitigation assumes emissions will peak around 2040, after which they will decline.

- RCP8.5: Business-as-usual assumes emissions will continue to rise throughout the 21st century.

Each pathway predicts future greenhouse gas concentrations caused by human activities, with varying degrees of physical impact.

We also conducted a transition risk analysis, this time using two climate change scenarios as our basis. The analysis factored in three dimensions: likelihood, significance and time frame (see previous sections).

Internal carbon pricing

As previously mentioned, we have begun evaluating the potential financial impacts of transition risks, starting with our highest-priority risk: increasing carbon prices. This risk was prioritised because of its expected significant influence on operating costs, investment decisions, and long-term competitiveness. We noted that the annual carbon costs for our own Scope 1+2 emissions could range from USD 12 to 89 million per annum by 2030 (this would be lower under the NDC scenario and higher under the Divergent Net Zero scenario).

As one risk mitigation measure, shadow carbon pricing is applied to all non-IT fixed asset investment applications. The average carbon price projections are calculated along the Nationally Determined Contributions (NDCs) scenario based on an unweighted average across all dormakaba’s countries of operation, and an 8% discount rate is applied based on the Weighted Average Cost of Capital (WACC) listed in our financial filings. The investment application provides the user with transparency on the total cost of energy (electricity and/or heating fuels) and total cost of carbon for the entire lifetime of the machinery up until 2045.

The carbon price is dynamic, increasing every five years and ranging from CHF 43 CHF per tCO2 up to CHF 99 as of 2040. The impacts of the carbon and energy costs are integrated into cashflow, EBITDA and internal rate of return calculations for the accounting lifetime of the machinery (10 years). In addition, we use the expected future cost of Gold Standard carbon offsets (CHF 75 per tCO2) as an additional carbon price, as we expect this cost level associated with achieving carbon neutrality in our own operations starting in 2030.

The same shadow carbon pricing is applied to potential acquisitions during due diligence processes related to M&A activities. These approaches ensure that both environmental and financial considerations are central to our investment strategies, supporting our commitment to sustainable growth.

Our climate transition plan

We are opening the doors wide to a low-carbon economy. We aim to be net zero by 2050 at the latest. Let’s look closer at our near-term Scope 1+2 targets.

Absolute emissions targets: Scope 1+2

As approved by the Science Based Targets initiative (SBTi), our target is to reduce absolute Scope 1+2 greenhouse gas (GHG) emissions by at least 42% in line with a 1.5°C future by 2030, without the use of carbon offsets (baseline 74,770 tCO2e in FY 19/20). This means total emissions savings of 31,403 tCO2e versus the baseline. Any residual emissions will then be voluntarily compensated through Gold Standard offsets to achieve our target of becoming carbon neutral by 2030. In line with our science-based emission reduction targets, we aim to reduce the energy intensity of our operations by 25% by 2030 (baseline 100.5 MWh/mCHF in FY 19/20).

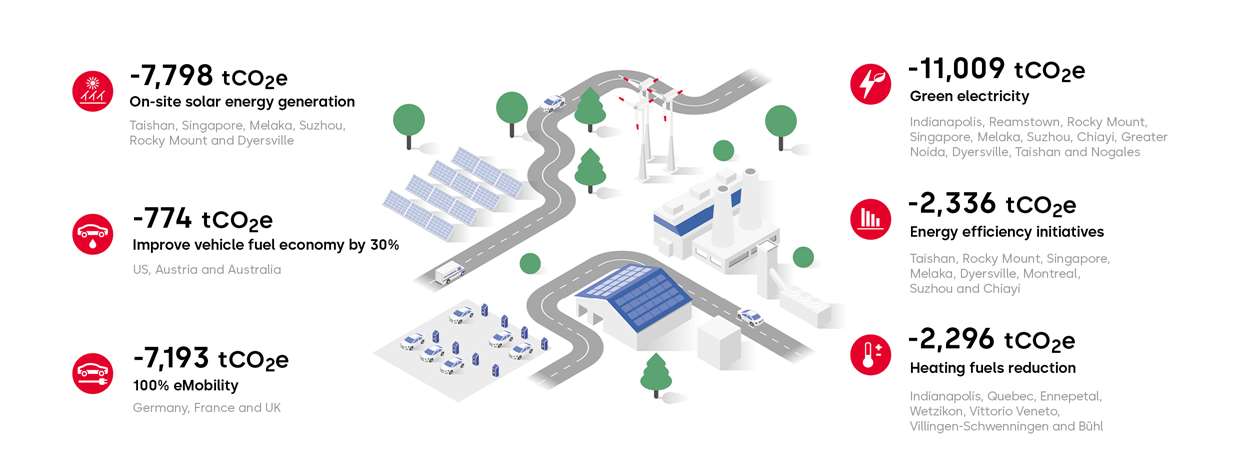

Our strategy

To achieve the 42% reduction (31,403 tCO2e) of Scope 1 and 2 emissions, we have set must-have initiatives along six levers, which must be completed by 2030. These initiatives are executed at dormakaba sites, where we can have the largest impact on reducing our CO2 emissions. The climate transition plan was approved by the Executive Committee and Board of Directors as part of our Sustainability Framework and target-setting approval process described here. We are on track with our Scope 1 and 2 climate action plan and already achieved a 25% reduction since the baseline in FY 19/20.

Our levers and contributing locations

Absolute emissions targets: Scope 3 Category 1 and 11

We have also set a target to reduce our value chain emissions (Scope 3) from purchased goods and services, and the use of sold products by 25% by 2030 (baseline 734,850 tCO2e in FY 19/20).

Scope 3 emissions constitute around 90% of our combined Scope 1, 2, and 3 carbon emissions, highlighting the importance of Scope 3 emissions for our climate strategy. While setting our baselines, we carried out screening across all relevant Scope 3 emissions categories, which showed that the largest sources of Scope 3 emissions are Category 11: Purchased goods and services and Category 11: Use of sold products. This is why we have set our SBTi targets based on these two categories.

We do not yet have a granular climate transition plan for Scope 3 Category 1, primarily because emissions data is reported on spend or on a material type basis, rather than disaggregating to an individual supplier level. This means we have little leverage to encourage suppliers to decarbonize. To address this, in FY 24/25 we started to collect primary CO2 data from our most carbon-intensive suppliers. Unfortunately, our external partner could not finalize the supplier engagement program. We are currently evaluating alternative solutions to address the issue and better support our suppliers on their decarbonization journey. In the meantime, we are working closely with metal suppliers to evaluate if they can deliver low-carbon goods with higher recycled content to build a preferred supplier database and evaluate potential switches.

Innovation for a low-carbon economy

When it comes to primary energy consumption, the building sector is one of the largest consumers of energy in the world —as a result, its influence on climate change is enormous. As part of our Scope 3 Category 11 strategy, we have set a target of having best-in-class energy efficiency for new products, which we have achieved last year. Our digital Product CO2 Inventory Tool has been supporting us here, as it provides information on the carbon emissions of energy-consuming products during their use phase (the calculation method is in line with the GHG Protocol). The tool includes the footprint of around 350 products that consume energy after installation, including those that are battery-operated or connected to the electricity grid. This facilitates product development and optimization activities to create more energy-efficient products and also contributes to our target of decreasing Scope 3 emissions from the use phase of sold products.

We continue to include the top 10 carbon-intensive products from the digital Product CO2 Inventory Tool in our sustainability initiatives tracker, tasking product development teams with evaluating and implementing energy efficiency strategies for them.

We also offer sustainable solutions to help address Scope 4 emissions: our Motion IQ, which is an intelligent sensor system for automatic doors, and our Door Efficiency Calculator, which is a tool that helps customers choose the most energy-efficient entrance solution for their building.

Our MotionIQ system ensures that automatic doors only open when they really need to and for no longer than necessary. This means the doors move less frequently, thus reducing air exchangeand minimizing the amount of energy needed for heating or cooling indoor air. Using the MotionIQ system together with swing door operators typically saves 50% of energy versus without. Additionally, the service life of the drive technology is extended, as unnecessary openings are avoided.

Our Door Efficiency Calculator makes it possible to compare and analyze different automatic doors in terms of their impact on a buildingʼs airflow, energy use, and CO2 emissions, depending on factors such as building type, usage, and typical weather conditions for the site. This tool provides our customers with a valuable decision-making aid for selecting the best solution that also meets the requirements of the building in question.

Our performance

Scope 1 and 2 emissions

Greenhouse gas emissions by source (tCO2e)

Scope 1 and Scope 2 greenhouse gas emissions (tCO2e)1

In FY 24/25, our total greenhouse gas (GHG) emissions (Scope 1+2) amounted to around 56,000 tCO2e, dropping 10% versus the previous financial year, in part due to updates in the emission factors being applied. Around half were emitted as a consequence of electricity consumption, followed by vehicle fuels consumption. Key decarbonization projects and initiatives which began in FY 24/25 will result in total emissions avoidance of approximately 1,700 tCO2e. Among these, energy efficiency and heating fuels reduction projects will lead to 1,433 MWh savings per annum. However, as a whole, energy consumption increased by 1.5% to 244,335 MWh due to production increases. Energy intensity remained relatively stable at 85.1 MWh/mCHF net sales (vs. 84.8 in previous year).

Key decarbonization activities

|

Lever |

|

Location |

|

Initiative |

|

OpEx investment in FY 24/25 (CHF thousand) |

|

CapEx investment in FY 24/25 (CHF thousand) |

|

Expected energy savings (MWh/year) |

|

Expected CO 2 savings (tCO 2 e/year) |

|

|

On-site solar generation |

|

Hallam (Australia) |

|

Photovoltaic solar installation |

|

0 |

|

94 |

|

N/A |

|

151 |

|

|

Green electricity |

|

Suzhou (China) |

|

Switch to green electricity |

|

0 |

|

0 |

|

N/A |

|

752 |

|

|

Vehicle fuels reduction |

|

Hallam (Australia) |

|

Switch to hybrids |

|

0 |

|

1,167 |

|

0.1 |

|

31 |

|

|

Heating fuels reduction |

|

Vittorio Veneto (Italy) |

|

External window replacement |

|

0 |

|

466 |

|

24.0 |

|

17 |

|

|

Energy efficiency |

|

Chiayi (Taiwan) |

|

Assembly AC replacement |

|

0 |

|

98 |

|

77.0 |

|

48 |

|

|

|

Rocky Mount (USA) |

|

Air compressor replacement |

|

0 |

|

156 |

|

276.2 |

|

94 |

|

|

|

|

Singapore |

|

Paint Shop compressor |

|

0 |

|

71 |

|

179.3 |

|

74 |

|

|

|

Machine cooling |

0 |

|

|

22.2 |

|

5 |

|||||||

|

Proof of concept (phase 1) - Mechanical fan replacement to Electronically Commutated (EC) fans |

0 |

|

|

21.6 |

|

9 |

|||||||

|

|

Suzhou (China) |

|

Chiller replacement |

|

0 |

|

399 |

|

134.1 |

|

84 |

|

|

|

Pinion oil pump - off-cycle |

0 |

|

|

19.4 |

|

12 |

|

||||||

|

Reduce compressed air |

0 |

|

|

78.9 |

|

49 |

|

||||||

|

|

Taishan City (China) |

|

Air compressor optimization |

|

0 |

|

0 |

|

231.1 |

|

145 |

|

|

|

Chiller optimization |

0 |

|

|

78.1 |

|

49 |

|

||||||

|

Process optimization - Polishing line |

0 |

|

|

291.4 |

|

182 |

|

Scope 3 emissions: Category 1 and 11

Scope 3 emissions: purchased goods and services (tCO2e)1, 2

Scope 3 emissions: use phase of products (tCO2e)3

Achieved GHG reductions

|

|

|

Retrospective |

|

Milestones and targets |

||||||||||||

|

|

|

FY 19/20 |

|

FY 23/24 |

|

FY 24/25 |

|

FY 24/25 vs. FY 23/24 (%) |

|

FY 25/26 |

|

FY 29/30 |

|

FY 49/50 |

|

Annual % target / Base year |

|

Scope 1 + 2 GHG emissions (tCO 2 e) 1 |

|

74,770 |

|

62,269 |

|

55,929 |

|

–10.2% |

|

55,927 |

|

43,366 |

|

7,477 |

|

4.2% |

|

Scope 1 GHG emissions |

|

31,162 |

|

29,520 |

|

27,199 |

|

–7.9% |

|

23,308 |

|

18,073 |

|

3,116 |

|

4.2% |

|

Scope 2 GHG emissions |

|

43,608 |

|

32,749 |

|

28,730 |

|

–12.3% |

|

32,619 |

|

25,293 |

|

4,361 |

|

4.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant Scope 3 GHG emissions (tCO 2 e) |

|

734,850 |

|

838,248 |

|

785,778 |

|

–6.3% |

|

642,994 |

|

551,138 |

|

73,485 |

|

2.5% |

|

Category 1: Purchased goods and services |

|

567,250 |

|

692,254 |

|

679,368 |

|

–1.9% |

|

496,344 |

|

425,438 |

|

56,725 |

|

2.5% |

|

Category 11: Use of sold products |

|

167,600 |

|

145,994 |

|

106,410 |

|

–27.1% |

|

146,650 |

|

125,700 |

|

16,760 |

|

2.5% |

|

Total GHG emissions in scope of our SBTi targets |

|

809,620 |

|

900,517 |

|

841,707 |

|

–6.5% |

|

698,921 |

|

594,504 |

|

80,962 |

|

|

1 All data in the table is in tCO 2 e. Scope 2 is market-based

In alignment with our decarbonization strategy, GHG removals and/or financed GHG mitigation projects through carbon credits have not been utilized during this reporting period.

EU Taxonomy

The EU taxonomy allows financial and non-financial companies to share a common definition of economic activities considered to be environmentally sustainable, recognizing that shifting capital flows towards more sustainable activities requires a shared, holistic understanding of the environmental impacts of activities and investments.

Based on the EU taxonomy technical screening criteria, a company’s internal economic activities can be classified according to their environmental sustainability. The classification system is broken down into six environmental objectives:

- Climate change mitigation

- Climate change adaptation

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

- Sustainable use and protection of water and marine resources

Economic activities that have the potential to contribute to one of the environmental objectives are referred to as taxonomy-eligible. Those taxonomy-eligible activities that are actually environmentally sustainable are referred to as taxonomy-aligned. Taxonomy alignment requires fulfillment of the following three criteria sets:

- Substantial contribution to one of the six environmental objectives

- No significant harm regarding the other five environmental objectives (Do No Significant Harm, DNSH)

- Compliance with minimum social and governance requirements (minimum safeguards)

Articles 3 and 9 of Taxonomy Regulation (EU) 2020/852 (Taxonomy) require dormakaba to disclose sales, capital expenditure (CapEx), and operating expenditure (OpEx) related to environmentally sustainable economic activities.

After thorough examination of Technical Annex 1 of the Taxonomy Regulation (EU) 2020/852, and the Commission Delegated Regulation (EU) 2023/2486, we have found that only a few of our revenue-generating activities are taxonomy-eligible with respect to climate change adaptation and mitigation. We conducted this review against the full scope of our products and solutions together with the Product Sustainability department and Product Managers. It was found that the EU taxonomy classification is largely not applicable to the majority of our revenue-generating activities — nor to that of the access solutions industry in general. On the other hand, greater alignment on eligibility can be seen in the area of the circular economy. There was no eligibility found at this time regarding the environmental objectives of pollution prevention and control, protection and restoration of biodiversity and ecosystems, and sustainable use and protection of water and marine resources. We will reevaluate this on a regular basis, however.

The company’s eligible activities related to revenue are listed in the table below.

|

Objective |

|

Economic activity |

|

Taxonomy-eligible activities |

|

Climate change adaptation and mitigation |

|

3.5. Manufacture of energy efficiency equipment for buildings |

|

Manufacture of doors that could be installed as external doors with U-value lower than or equal to 1.2 W/m 2 K* |

|

Substantial contribution to the transition to a circular economy |

|

1.2. Manufacture of electrical and electronic equipment |

|

All new electrical products include the circularity approach |

|

|

|

4.1. Provision of IT/OT data-driven solutions |

|

We develop, install, deploy, maintain, repair, and provide professional services related to operational technologies for some of our products. |

|

|

|

5.2. Sale of spare parts |

|

We sell spare parts to maintain the functionality of the product. |

* Taxonomy Report 2020/852 Technical Annex 1, section 3.5. Manufacture of energy efficiency equipment for buildings; relating to “doors with U-value lower or equal to 1.2 W/m 2 K”. Revenues from all doors that could be installed as external doors were therefore defined as eligible. Product management then reported the U-values for all such doors to determine taxonomy alignment.

Cross-cutting activities to which only capital and operating expenditures are attributed were also considered, such as solar PV projects, electric vehicle charging installations, and energy efficiency initiatives. Eligible activities can be found below.

|

Objective |

|

Economic activity |

|

Taxonomy-eligible activities |

|

Climate change adaptation and mitigation |

|

4.1 Electricity generation using solar photovoltaic technology |

|

Installation and operation of solar panels on the rooftops of our manufacturing sites, such as in Australia in FY 24/25 |

|

|

|

7.3 Installation, maintenance, and repair of energy efficiency equipment |

|

Installation of new air compressors or other energy-consuming equipment |

A summary of the results for FY 24/25 can be found below. The investment and spend values related to CapEx and OpEx were taken into account only for those initiatives that are eligible and/or aligned and that are tracked and controlled in our global Sustainability Initiatives tracker tool to prevent double counting. A due diligence assessment against the minimum safeguards and DNSH criteria was undertaken by our Human Rights function. The detailed breakdown by environmental objective related to turnover and CapEx can be found in the Indices section of this report.

|

|

|

Taxonomy-aligned |

|

Taxonomy-eligible but not aligned |

|

Taxonomy-eligible |

|

Taxonomy non-eligible |

|

Turnover 1 |

|

0.2% |

|

27.0% |

|

27.2% |

|

72.8% |

|

CapEx 2 |

|

1.2% |

|

0.0% |

|

1.2% |

|

99% |

1 Turnover (eligible): Net sales from external doors, software, spare parts, electronic products. For the latter three, alignment was not assessed and therefore categorized as not aligned. Turnover (aligned): Net sales from doors with a thermal efficiency U-value of less than or equal to 1.2 W/m 2 K

2 CapEx includes: CapEx for generation of renewable energy (e.g., solar power installations); CapEx for energy efficiency initiatives