Supplier Sustainable Development

To further develop partnerships in the supply chain based on responsible business behavior, we are engaging our suppliers and trading partners in our endeavor to foster sustainable development.

Our approach

We believe sustainable supply chains ensure the well-being of the people and environments they procure from, as we seek to grow our business through ethical and legal business practices. We are therefore committed to leveraging our purchasing power to benefit those partners whose values align most closely with ours. Furthermore, the rise of supply chain transparency legislation points to the increasing mandate that a company must be aware of the economic, environmental, and social dimensions of its supply chain, and that it must proactively monitor and manage those dimensions.

The dormakaba Supplier Code of Conduct (SCoC) outlines our requirements with regard to human rights, fair working conditions, environmental responsibility, and business ethics, among others things. It is integrated into our online bidding system and is also part of our standard supplier contracts.

In 2022 we adopted the dormakaba Sustainable Procurement Directive, which includes basic regulations on contractual sustainability agreements, sustainable purchasing factors and criteria, requests for sustainability information, life cycle costing, supplier categorization for sustainability assessments, and procedures in case of non-participation or non-compliance.

Our activities

Our global supply chain is large and complex, which poses a challenge in this regard. Global procurement volumes with external vendors, excluding inventory, correspond to approximately 39% of total sales, making the company’s procurement strategy highly relevant to achieving our financial and sustainability targets. The number of active suppliers for goods and services is approximately 16,500, with spend focused in Europe (49.0%), North America (27.7%), and Asia (19.2%).

We are setting higher standards for our suppliers to foster circular solutions. Learn more about how we are increasingly sourcing recycled materials, and Forest Stewardship Council-certified products.

Supplier Sustainable Development is one of the strategic topics in our Sustainability Framework 2021–2027, for which we have set ambitious targets. By 2027, we aim to:

- assess all high-risk suppliers for their sustainability management via a third party or off-board them for lack of participation.

- have at least 45% of our high-risk suppliers participate in our sustainability engagement program.

- close at least 80% of high-priority corrective actions via assessed suppliers.

- have 90% of assessed suppliers with priority findings complete a sustainability training.

- provide information regarding conflict minerals for high-risk suppliers.

To ensure our suppliers contribute to social and environmental well-being, dormakaba focuses on five areas:

- Identifying supply chain risks

- Supplier off-site assessments

- Supplier on-site audits

- Training of internal and external stakeholders

- Procedures in case of non-participation or non-compliance

Identifying supply chain risks

dormakaba has defined a target group for sustainability assessments based on identified sustainability risk factors – such as origin country and the material content of the goods procured. The latter refers to Material Compliance topics, assessing materials of concern that are regulated, for example, by the European Union’s REACH regulations and RoHS Directive. Suppliers over a certain procurement threshold were taken into consideration as part of the categorization work.

To determine sustainability risk factors on a country level, an impact assessment and hotspot analysis were used as a baseline. The hotspot analysis identified the following sustainability topics as being of the highest relevance in the supply chain: (1) Energy and Emissions; (2) Human Rights; (3) Child Labor and Forced Labor; (4) Materials; (5) Responsible Tax Practices; (6) Freedom of Association; and (7) Circular Economy. For these high-impact topics, any supplier from countries listed as high-risk was included in the sustainability target group for assessment. The high-risk group includes approximately 13% (2,089) of our Tier 1 supplier base, both for direct (e.g. material goods) and indirect (e.g. services) spend. The target group was not updated in FY 22/23 in comparison with FY 21/22. It is based on the latest available full-year data from the procurement information systems (FY 20/21).

Supplier categorization for sustainability assessment

Baseline study to increase the recycled content of metals

Due to our supply chain risk and categorization process, we are aware that the topic of Energy and Emissions has the largest impact. Indeed, a key element of our climate transition plan is to choose goods with smaller carbon footprints.

According to the American Geosciences Institute, the largest energy savings achieved through recycling are associated with metals. Primary metals are predominantly produced using energy-intensive mining and ore processes, which are between 50% and 80% more energy-intensive than the process of choice for producing secondary/recycled metal, depending on the metal recycled. This reduction of energy used leads to clear CO2 savings. For example, recycling aluminum saves 94% of CO2 emissions versus producing aluminum from raw materials (source: US Aluminum Association).

As metals make up around one third of our Scope 3 emissions stemming from purchased goods and services, we are putting special focus on increasing the amount of recycled content purchased.

In the first year of the initiative, we have been developing a baseline for recycled content with our existing metal suppliers. This project includes 164 suppliers (105 steel, 24 brass, and 35 aluminum suppliers) covering the Regions AMER, EMEA, and APAC. With this study, dormakaba will be able to direct purchasing toward those suppliers capable of delivering the highest overall recycled content, thereby reducing value chain emissions related to metal extraction, production, and processing. We are happy to be pioneers in this topic, as our suppliers and customers have highlighted. But being pioneers is challenging, because many suppliers have never had similar requests and must create new processes to deliver the requested information.

Furthermore, gathering this information is especially challenging for traders who receive raw materials from several sources, and who tend to have short-term supplier relationships. This points to issues in achieving our environmental standards within their business models. Of the 164 suppliers included in the baseline study, 68 have been contacted. However, only three have returned the signed affidavit as requested. Due to the low response rates, we will put extra emphasis on the baseline study in the upcoming financial year, and we will continue to work with our suppliers to improve data quality and responses. Additionally, we have included minimum recycled content levels for metals in our Environment Directive and in our supplier management tool SAP Ariba to address this topic from the vry beginning of a supplier relationship.

Supplier off-site assessments

Since 2019, we have been working together with EcoVadis, a leading provider monitoring sustainability in global supply chains, to reduce supplier risk and support supplier development. The assessment covers 21 sustainability criteria across four areas (environment, labor and human rights, ethics, sustainable procurement).

We invited over 500 high-risk suppliers from our Tier 1 group to participate in the EcoVadis assessment in FY 22/23.

In FY 22/23, we engaged 503 high-risk suppliers and asked them to participate in the EcoVadis assessment (versus the 500 targeted suppliers). The positive participation rate was 31%. Of the suppliers with a completed rating as at 30 June 2023, 56% landed in the score band of “good” or above. However, 35% had only partial performance, with scores lower than 45. And an additional 9% were considered to have insufficient performance.

Since the launch of our collaboration with EcoVadis, 23.7% of our high-risk suppliers have been assessed. 270 high-priority corrective actions have been requested and 49% of these were closed. Furthermore, a total of 12 business relationships have been terminated and five suppliers were blocked from new business.

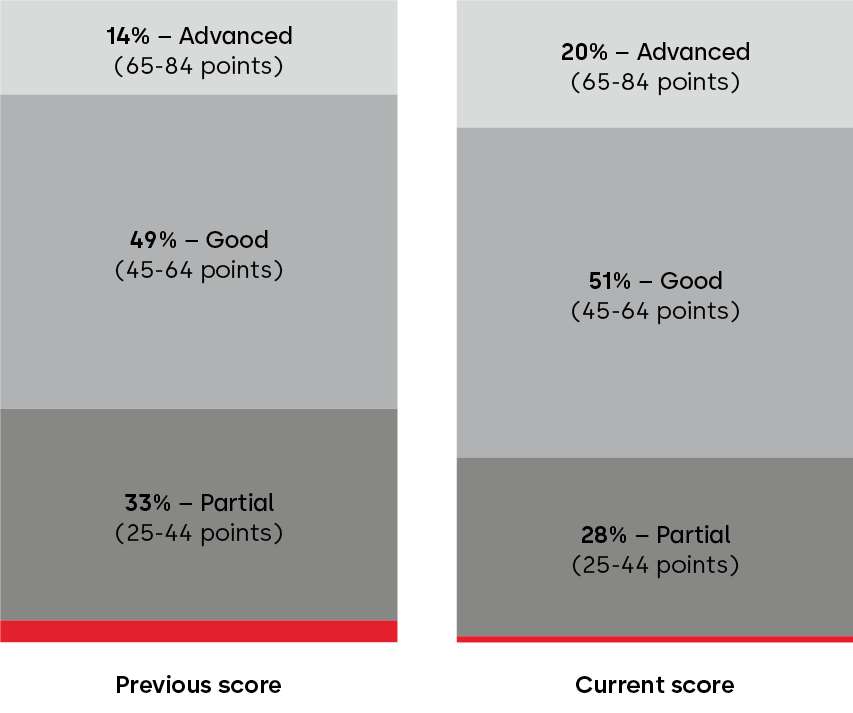

Overall score distribution*

Since the start of our cooperation with EcoVadis, 42% of assessed suppliers have undergone a follow-up reassessment. We found that 60% of the reassessed suppliers improved their score, with an overall improvement of 3.4 score points. Among those that improved, the average supplier improvements per pillar are:

- Environment: +3.6 points

- Labor and Human Rights: +3.5 points

- Ethics: +3.2 points

- Sustainable Procurement: +3.0 points

The majority of reassessed suppliers (51%) exhibited good performance, with an additional 20% considered to have advanced performance. We will continue to support our business partners to improve their rating in the future.

Supplier on-site audits

To examine our suppliers’ situation on-site, we developed a standard audit questionnaire that contains topics related to quality management. It includes checks on, sustainability topics such as internal Code of Conduct (CoC), the dormakaba Supplier Code of Conduct, labor, health and safety, and environmental standards. Auditors are asked to check documentation on-site related to:

- Workers’ ages and identity records

- Receipt of wages

- Training and communication on internal CoCs

- Signing of the dormakaba SCoC

- Hazardous materials storage and worker training on safe handling

- Injury rates

- Development of water, energy, and waste metrics over recent years

As on-site audits require immense effort and cost, we have introduced a risk assessment process that takes into account the potential risk of specific locations, products, and performance. This risk assessment results in a score ranking, indicating the frequency of auditing required for the relevant supplier.

In FY 22/23, our own quality team conducted on-site audits for 18 suppliers in China. There were no findings of non-conformance regarding sustainability criteria.

We also conducted four comprehensive on-site audits in China via a third-party focusing exclusively on sustainability. Three auditees were small subcontractors that posed risks to labor standards and human rights. The fourth audit was carried out as a result of one of our long-standing Chinese suppliers entering the sustainability escalation process.

The third-party audits were conducted by ELEVATE, a firm specialized in social auditing. The auditees’ performance in the areas of labor, health and safety, environment, business ethics, and management systems was assessed against the ERSA and CIA standards.

Despite having faced resistance from the audited suppliers when requesting that the assessment be conducted, all four suppliers complied and we have gained valuable insights into their compliance with social standards. Indeed, the final audit reports revealed major non-conformances with health and safety, and labor standards for all the suppliers assessed. For that reason, we have engaged ELEVATE once again to conduct a root cause analysis with each supplier and set specific corrective action plans.

One year after establishing the corrective action plan, dormakaba will check the implementation of the corrective actions, and adopt governance measures in those cases where the corrective actions have not been properly implemented.

Procedures in the event of non-participation or non-compliance

We have procedures and process flows in place for auditing and corrective action plans in terms of the sustainability performance of suppliers. We integrate a sustainable development clause into contracts for new suppliers and for existing suppliers when it is time for contract renewals. Our sustainability contractual clause establishes and describes the suppliers’ obligation to participate in and pay for off-site assessments and/or on-site audits, and to commit to and implement an improvement plan if performance is below our defined benchmarks.

In addition, at the beginning of the supplier relationship, the supplier is presented with the dormakaba SCoC for signature. Suppliers refusing to sign the SCoC or who do not have their own of equal quality are blocked.

If a supplier is invited to participate in the EcoVadis off-site assessment, further actions are determined by their assessment score. For suppliers with bronze, silver, gold, or platinum level, reassessments are required in two to five years. For suppliers with partial performance, an annual reassessment is required, and an improvement plan is defined within the EcoVadis system.

Refusal to participate in an off-site assessment qualifies a supplier for an on-site audit. Likewise, suppliers whose off-site assessment score is insufficient are shortlisted for an on-site audit. A corrective action plan is defined in the course of the on-site audit, with a one-year implementation deadline. Suppliers are blocked or placed in active elimination for lack of implementation.

A Responsible Procurement Steering Committee meets regularly to take decisions on a case-by-case basis for special circumstances, such as when dealing with monopoly suppliers, quality checks of suppliers’ internal Code of Conduct, acceptance of sustainability assessments provided by companies other than EcoVadis, and monitoring and evaluation of suppliers listed as blocked or in active elimination due to inadequate sustainability performance.

Sustainability trainings for procurement employees

Our procurement employees have a core role in achieving our goals related to Supplier Sustainable Development. Their understanding of the sustainability aspect and the program with EcoVadis is key. For this reason, employees working together with suppliers, participate in training programs that prepare them for sustainability- and assessment-related conversations with partners. In FY 22/23, 107 colleagues from procurement completed the virtual internal training on our sustainability framework, targets, and governance.

Further activities

We have seen greater focus and execution across all of our supplier sustainability engagement work thanks to organizational improvements within the company. There is now a dedicated team of four full-time employees working on a global level and embedded within the Regions AMER, APAC, and Europe & Africa to engage with our suppliers on general sustainability assessments and beyond. For example, this team arranged for further baseline checks on whether our packaging suppliers for wood, paper, and carton are certified by the Forest Stewardship Council. This groundwork will enable us to transition to those suppliers that are able to meet this new requirement, or to seek new suppliers.

The processes in the SAP Ariba system, which is used to automate processes for supplier onboarding, development, and communication, were aligned with new sustainability-related laws, regulations, and requirements. Using this system, we are able to simplify processes for suppliers related to labor, material compliance, high-risk materials and high-risk countries, as well as providing an escalation process for suppliers not compliant with the standards.

Lastly, as part of our goal to provide customers with information related to conflict minerals in our supply chain, we have continued to request Conflict Mineral Reporting Templates (CMRTs) from suppliers. By the end of FY 22/23, in the USA we had contacted more than 1,300 suppliers (excluding non-production suppliers and services), of which around 51% submitted Conflict Mineral Statements. Approximately 32% of the supplier responses indicated that no 3TGs (tungsten, tantalum, tin, and gold) were intentionally used in the delivered goods, 13% have a strong compliance program, and around 5% have weak conflict mineral procedures. For more information on the topic, please view our recently published Statement of Commitment on Responsible Minerals Sourcing.

Outlook

During the next financial year, a key element of our supply chain due diligence will be the continued integration of sustainability requirements in SAP Ariba processes. Furthermore, we will continue to invite at least 500 suppliers to complete our supplier assessments via EcoVadis throughout the year. The planned automation of communication with our suppliers will help us reach this goal.

We will also focus on the replacement of our packaging materials with sustainable and certified alternatives. Therefore, 25% of our paper, carton, and wood packaging will be replaced sources certified by the Forest Stewardship Council. Additionally, we will start a benchmarking study in order to identify sustainable solutions for plastic packaging bags.

The baseline study on recycled content in our metals will continue, and we aim to invite an additional 25% of our relevant suppliers to complete CMRTs. In addition, dormakaba has been engaged in cobalt traceability dialogue with key suppliers since FY 21/22. The goal of the discussions is to understand the joint upstream value chains and to collaborate on tackling the human rights and environmental risks present in them. In FY 23/24 we will revisit the project with a view to covering a larger number of suppliers.

Finally, we have selected an external partner to conduct supplier trainings on sustainability topics, and the first invitations to suppliers with high-priority corrective actions will be sent in FY 23/24. Our own procurement staff will also undergo training on the stipulations included in the Sustainable Procurement Directive.