Compensation architecture for the EC

dormakaba’s compensation system balances market competitiveness with internal equity, while rewarding for performance and long-term value creation. The total target compensation (annual base salary, short-term incentive target and long-term incentive award) for each EC member is set according to the relevant market benchmark for their role and comprises a competitive fixed salary and a variable, performance-related component that is driven by the success of the company. This allows EC members to be rewarded for their contributions to the company’s success and long-term value creation. The overall compensation consists of the following elements:

- Annual base salary;

- Benefits (such as retirement benefits);

- Short-term incentive;

- Long-term incentive (share-based compensation).

|

|

Fixed Compensation and Benefits |

|

Variable Compensation (target of at least 50% of total compensation) |

||

|

|

Annual Base Salary |

Benefits |

|

Short-term incentive (STI) |

Long-term incentive (LTI) |

|

Purpose |

Reflects the function (scope, responsibilities and skills of the individual) |

Establish a level of risk protection for the participants and their dependents |

|

Rewards company short-term performance |

Rewards company long-term performance, aligns with shareholdersʼ interests |

To ensure consistency across the organization, roles within the organization have been evaluated using the job evaluation methodology of Korn Ferry Hay Group. The job evaluation system is the basis for compensation activities such as benchmarking and determination of compensation structure and levels. For comparative purposes, dormakaba refers to external compensation studies that are conducted regularly by Korn Ferry Hay Group in most countries. Overall, these studies include the compensation data of 2,500 technology and industrial companies, including listed and privately held competitors in the security sector that are comparable with dormakaba in terms of annual revenues, number of employees, and complexity in the relevant national or regional markets. Consequently, there is no predefined peer group of companies that is used globally. Rather, the benchmark companies vary from country to country based on the database of Korn Ferry Hay Group. For the CEO role, the last benchmark analysis was performed in June 2022 based on the same peer group as for the BoD consisting of the following eleven Swiss listed companies: Bucher Industries, Clariant, Forbo, Georg Fischer, Landis+Gyr, OC Oerlikon, SFS Group, SIG Combibloc, Stadler Rail, Sulzer, and Tecan. The composition of the peer group is based the following criteria: market capitalization, annual sales, business model, industry, and compensation practices.

Total Target Compensation approach

As a principle, the total target compensation (annual base salary, short-term incentive target and long-term incentive awarded) paid to the EC members is based on the market median in the relevant national or regional market and must be within a range of –20% to +35% of this figure. The variable component of compensation (= short- and long-term incentives) is targeted to make for at least 50% of the total direct compensation. Thereof, the equity-based compensation opportunity (value of long-term variable compensation) is at least 30% of the total direct compensation.

Illustration of total target compensation mix for CEO and EC members:

As per January 1, 2024, Till Reuter was appointed CEO as successor to Jim Heng Lee. Due to his extensive experience as CEO and in leading large transformation, the total compensation was adjusted. The CEO’s annual total target direct compensation as of January 1, 2024, is composed as follows:

Following the organizational simplification implemented in the fiscal year 2022/23 three EC members changed their role per July 2023. The total target compensation of these EC members was reviewed to reflect their new roles and scope of responsibilities in comparison to peers and to their market. After these revisions, the average total target direct compensation of active EC members, excluding the CEO is composed as follows:

1. Annual base salary

EC members receive an annual base salary for fulfilling their role. It is based on the following factors:

- Content, responsibilities, and complexity of the function;

- External market value of the respective role: amount paid for comparable positions in the industrial sector in the country where the member works;

- Individual profile in terms of skill set, experience, and seniority.

2. Benefits

As the EC is international in its nature, the members participate in the benefits plans available in their country of employment. Benefits mainly consist of retirement, insurance, and healthcare plans that are designed to provide a reasonable level of protection for the participants and their dependents in respect to the events of retirement, disability, death, and illness/accident. The EC members with a Swiss employment contract participate in the occupational pension plans offered to all employees in Switzerland, which consist of a basic pension fund and a supplementary plan for management positions. The benefits offered by the pension fund of dormakaba in Switzerland are in line with benefits provided by other Swiss multinational industrial companies.

EC members under foreign employment contracts are insured commensurately with market conditions and with their position. Each plan varies in line with the local competitive and legal environment and is, as a minimum, in accordance with the legal requirements of the respective country.

Further, EC members are also provided with certain executive perquisites, such as a company car or car allowance, representation allowance, and other benefits in kind according to competitive market practice in their country of employment.

3. Variable compensation

The variable compensation consists of a short-term incentive (STI) and a long-term incentive (LTI).

3.1 Short-term incentive

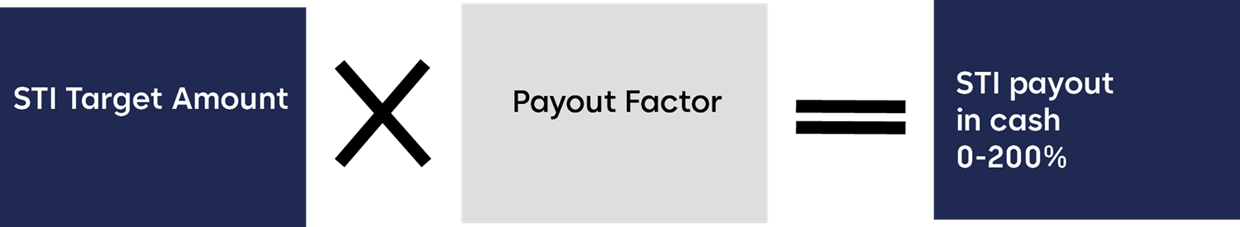

The short-term incentive is a target-based variable incentive delivered in cash. It is designed to reward the overall collective performance of the company to the dormakaba success over a one-year period, in line with the pay-for-performance compensation principle.

Each EC member including the CEO is allocated a target STI amount based on the benchmark and pay mix policy corresponding to the incentive amount to be paid if all performance objectives are met (100% target achievement). The target STI amount is reviewed annually and expressed as an absolute amount. It is determined considering the organization level and external benchmark for a similar function in the relevant market, the positioning of the individual’s total target compensation compared to that benchmark and the target pay mix for the position.

The table below sets out the STI payout amount opportunity expressed as a percentage of the annual base salary.

STI Payout range opportunity in % of annual base salary

|

|

|

Minimum threshold |

|

100% Target achievement |

|

Maximum threshold |

|

CEO |

|

0% |

|

100% |

|

200% |

|

Other active EC Members |

|

0% |

|

71%–91% |

|

142%–182% |

For the financial year 2023/24, the performance scorecard combining global, and unit specific targets was simplified with the aim of rewarding collective performance at Company level. The STI plan 2023/24 is determined solely by the achievement of financial goals at global level including Organic Sales, adjusted EBITDA Margin and adjusted ROCE for all EC members including the CEO. Each of the three goals is equally weighted.

Overview of short-term incentive performance objectives and respective weightings for FY 2023/24

At the beginning of the performance period, the NCC approves the minimum, target, and maximum achievement for the respective performance objectives. For performance below or at the minimum, 0% is paid out, whereby on-target performance (budget) is rewarded with a 100% payout. In case of overperformance, up to 200% can be achieved. Linear interpolation applies between the minimum threshold and the maximum threshold (cap) as in the prior performance period, for all three performance objectives.

For all performance objectives, the required achievement level is derived from the company’s strategic business plan and aligned with an ambitious budget for the respective financial year.

|

Performance indicators |

|

Organic net sales growth |

|

EBITDA Margin |

|

ROCE |

|

Performance period |

|

Financial year 2023/24 |

||||

|

Weighting |

|

1/3 |

|

1/3 |

|

1/3 |

|

Purpose |

|

Measure growth achieved by internal initiatives |

|

Measure Group operational profitability |

|

Measure efficiency of capital employed |

|

Measurement |

|

Organic net sales compared to target |

|

Earnings before interest, taxes, depreciation and amortization (“EBITDA”) adjusted for Items Affecting Comparability (IAC) 1 as a percentage of net sales. |

|

EBIT adjusted for Items Affecting Comparability (IAC) 1 divided by capital employed (CE) 2 results in ROCE. For the calculation, the average of the last three published balance sheet information is considered (Actual, half, and prior year). |

1 Content of Items Affecting Comparability is described in the note 5.2 Alternative performance measures (APM).

2 CE equals the sum of net working capital, property, plant, and equipment and intangible assets, excluding goodwill. Net working capital is defined as trade receivables plus inventories, minus the sum of trade payables, advances from customers, and deferred income.

As internal financial targets and related corridors for payout represent commercially sensitive information, no further details on the required achievement levels are disclosed at the beginning of the performance period. However, relevant performance achievements and the resulting STI payout factor for the financial year 2023/24 are reported in sections "Compensation awarded to the EC in financial years 2023/24 and 2022/23" and "Performance in FY 2023/24". The calculation of the short-term incentive is determined based on key performance indicators as reported in the financial statement.

The STI is paid in cash in the following financial year. In the case of termination of employment during the performance period, the payout of the STI may be reduced or forfeited depending on the conditions of such termination and subject to the applicable law.

3.2 Long-term incentive

The purpose of dormakaba’s long-term incentive plan is to provide the EC with an ownership interest in the company and a participation in its long-term performance and thus to align their interests to those of dormakaba shareholders.

The LTI plan is a performance share unit (PSU) plan vesting over three years. At the beginning of the vesting period, a number of PSUs is granted to each EC member.

As of the LTI grant made in the reporting period, the grant size is set as a monetary amount strictly considering the organization level and external benchmark for a similar function in the relevant market, the positioning of the individual’s total target compensation compared to that benchmark and the target pay mix for the position. Other criteria such as individual performance, strategic importance of projects and need for retention considered until the 2022 grant are no longer relevant.

The number of PSU granted is calculated by dividing the grant size (monetary amount) by the reference share price (volume weighted average share price over three months preceding the grant date).

The PSU vest after a period of three years, subject to the achievement of performance conditions. The LTI performance indicators include relative Total Shareholder Return (TSR), Earnings per Share (EPS), and Sustainability (ESG) related targets. ESG targets have been introduced as from the grant 2023 to reflect the increasing importance of sustainability and cover both social and environmental topics that are addressed by our sustainability strategy.

The tables below illustrate the payout range opportunity and the details on the LTI performance metrics in terms of definition and weighting for the CEO and the other EC members:

LTI at target payout range opportunity in % of annual base salary

The table below sets out the LTI payout amount opportunity expressed as a percentage of the annual base salary.

|

|

|

Minimum threshold |

|

100% Target achievement |

|

Maximum |

|

CEO |

|

0% |

|

100% |

|

200% |

|

Other active EC Members |

|

0% |

|

70%–91% |

|

140%–182% |

The vesting level may range from 0% to a maximum of 200% of the original number of units granted (maximum two shares for each performance share unit originally granted); there is no vesting below the threshold levels of performance. The vesting rules are detailed below.

Overview of long-term incentive performance objectives and respective weightings for FY 2023/24

|

Performance indicators |

|

TSR 1) |

|

EPS 1)3) |

|

ESG (as of grant 2023) |

||

|

Performance period |

|

Financial year 2023/24 to financial year 2025/26 (three years) |

||||||

|

Weighting |

|

40% of the PSU grant |

|

40% of the PSU grant |

|

10% of the PSU grant |

5% of the PSU grant |

5% of the PSU grant |

|

Purpose |

|

Align with dormakaba’ shareholders’ return |

|

Gain market shares in dormakaba’s relevant markets |

|

Contribute to climate change mitigation |

Foster a proactive safety culture |

Address customer needs in achieving green building standards and codes |

|

Measurement |

|

Share price increase + dividends over average of three percentile ranks compared to the SPI Industrial index 2) |

|

Average EPS growth during the 3-year performance period compared to the 3-year average EPS growth immediately preceding the performance period. The EPS growth must outperform the GDP growth in the relevant markets by 200bps. |

|

Carbon Emission Savings (Scope 1+2 market-based) measured against baseline FY 2019/20 at the close of the three-year performance period. Based on the Science Based Targets initiative (SBTI) approved targets, dormakaba committed to save 42% versus baseline FY 2019/20 until end of FY 2029/30. |

Safety Improvement: Reduction of recordable work-related injury rate with aim for –5.5% per annum (–27.5% at the close of the three-year performance period vs. baseline FY 20/21. This is measured by dividing the total number of recordable work-related injuries by the total working hours multiplied by the factor 200,000. |

Increased sustainability products declarations & certifications measured by a count of the total number of sustainability product declarations and certifications published on dormakaba Group website at the end of the three-year performance period. |

|

Target level 100% vesting |

|

Median of the peer group |

|

200bps point above GDP growth |

|

55,927 Scope 1+2 tCO 2 emissions (25% reduction vs. baseline FY 2019/20) |

1.02 injury rate (27.5% improvement vs. baseline FY 2020/21) |

312 sustainability product declarations or certifications |

|

|

|

|

||||||

|

Minimum Threshold 25% vesting |

|

25th percentile |

|

70% of target achievement |

|

58,282 Scope 1+2 tCO 2 emissions (22% reduction vs. baseline) |

1.07 injury rate (23.5% improvement vs. baseline) |

291 sustainability product declarations or certifications |

|

|

|

|

||||||

|

Maximum payout level 200% vesting |

|

83.33th percentile |

|

140% of target achievement |

|

52,786 Scope 1+2 tCO 2 emissions (29% reduction vs. baseline) |

0.94 injury rate (33% improvement vs. baseline) |

340 sustainability product declarations or certifications |

|

|

|

|

||||||

1 2022: 50%

2 The SPI Industrials index was selected as the performance benchmark because of the insufficient number of direct competitors of dormakaba that are publicly listed, which does not allow for a suitable customized peer group. Therefore, the SPI Industrials as an index of companies of comparable size listed on the SIX Swiss Exchange, was the most appropriate alternative.

3 In accordance with the LTI plan rules, the EPS calculation may be adjusted for extraordinary items in accordance with Alternative Performance Measures (APM) adjusted for Items Affecting Comparability (IAC) and must be approved by the Board.

The vesting formula has been designed in line with market practice for Swiss publicly traded companies to combine pay-for-performance compensation principles and reach alignment with the long-term shareholder interest. It has both challenging targets and no excessive leverage. To reach the target, the company needs to outperform half of the peers in respect of relative TSR and needs to outperform GDP growth by 2 percentage points on the EPS condition. ESG performance targets included in the LTI align with the sustainability framework as approved by the BoD in 2021 . While there is no payout below the threshold levels of performance, a partial payout is still possible for a performance between the threshold and the target. On the other side, an extraordinary performance is required to reach the cap of 200%.

Performance share units are usually awarded annually in September. In the case of voluntary termination by the participant or if a participant is terminated for cause, performance share units are forfeited without any compensation. In the case of termination without cause or retirement, performance share units are subject to a pro rata vesting at the regular vesting date. In case of disability, death, or change of control, performance share units are subject to an accelerated pro rata vesting based on a performance assessment by the BoD (see also Corporate Governance Report). The conditions for the award of performance share units are governed by the stock award plans of dormakaba.

Shares awarded in reporting periods 2023/24 and 2022/23 have come from dormakaba treasury shares.

The long-term incentive awards have been subject to claw-back and malus provisions since 2019. In certain circumstances, such as in the case of financial restatement due to material non-compliance with financial reporting requirements, fraudulent behavior or substantial willful misconduct, the BoD may decide to suspend the vesting or forfeit any granted long-term incentive award (malus provision) or to require the reimbursement of vested shares delivered under the long-term incentive (claw-back provision).

4. Employment contracts

The EC members are employed under employment contracts of unlimited duration that are subject to a notice period of up to twelve months. EC members are not contractually entitled to sign-on awards, termination payments, or any change of control provisions other than the accelerated vesting and/or unblocking of share awards mentioned above. The employment contracts of the EC members may include post-employment non-competition clauses for a duration of up to a maximum of two years. In cases where the company decides to activate the post-employment non-competition provisions, the compensation paid in connection with such non-competition provisions may not exceed the monthly base salary, or half of the total compensation, for a period of twelve months.

5. Shareholding ownership guideline

The EC members are required to own a minimum multiple of their annual base salary in dormakaba shares within five years of hire or promotion to the EC, as set out in the following table:

|

CEO |

|

300% of annual base salary |

|

EC member |

|

200% of annual base salary |

To calculate whether the minimum holding requirement is met, all vested shares are considered, regardless of whether they are restricted or not. However, unvested performance share units are excluded from the calculation. The NCC reviews compliance with the share ownership guideline on an annual basis. In the event of a substantial rise or drop in the share price, the BoD may, at its discretion, review the minimum ownership requirement. As of 30 June 2024, all EC members comply with the share ownership guideline.