Notes to the consolidated financial statements for the 2023/24 financial year

1. Performance

This section provides information on the operational performance of dormakaba Group and the current operating model, the outlook on the organizational changes and its implication on the operating model, as well as on the segment disclosure. The description of the operating model provides information useful in understanding the segment reporting, which corresponds to the Groupʼs internal reporting system. In addition, information is presented on selected income and expense items.

1.1 Segment reporting

Operating model and organizational structure

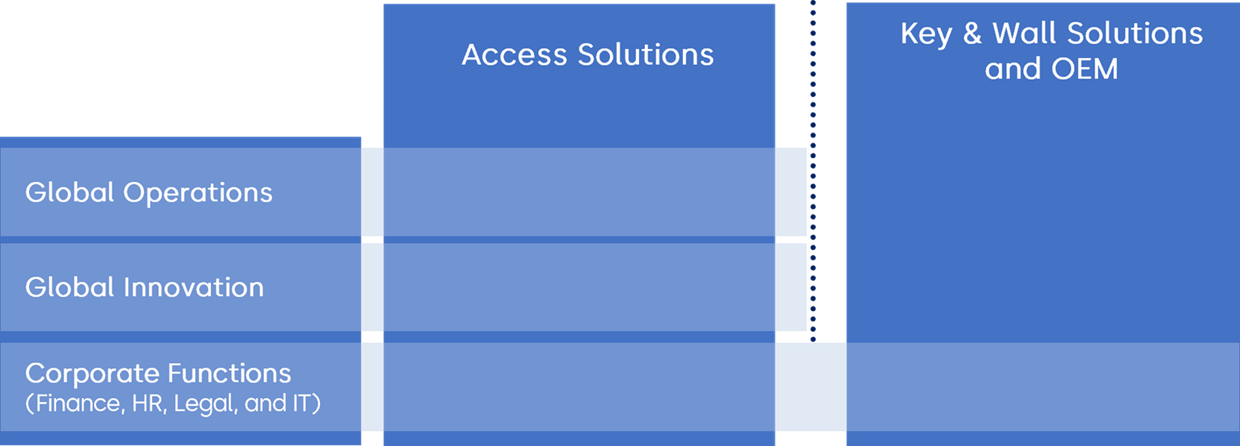

The Access Solutions (AS) business consists of the AS commercial business under one leadership of a Chief Commercial Officer (CCO) with support by Global Functions Operations and Innovation.

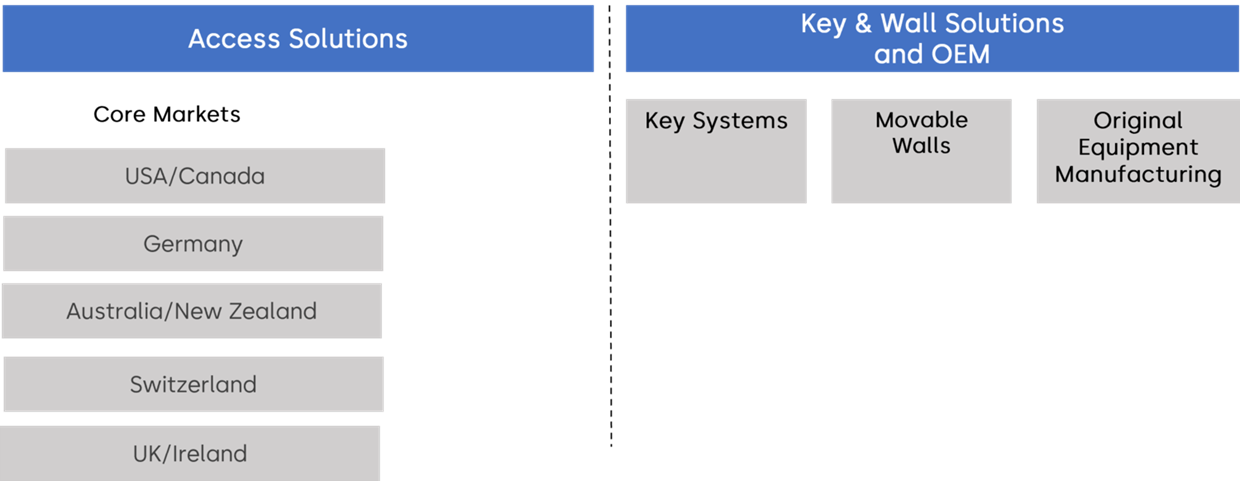

The company’s five core markets (USA/Canada, Germany, Australia/New Zealand, Switzerland, UK/Ireland) as well as China and India are reporting directly to the CCO; together they represent around 70% of Access Solutions sales. To enable a strong customer focus and sales generation, the key markets are built around:

- Project and solution sales (“direct business”), focusing on end customers, general and technical contractors;

- Product and system sales (“indirect business”), focusing on distributors, value-added resellers, system integrators, and OEMs;

- Service sales, focusing on facility managers, building operators, or installers to support services growth as part of the global core;

- Furthermore, we support the above with pull generation via specification and support to architects, design engineers, planners, and other influencers.

Key & Wall Solutions and OEM completes the organizational setup as a standalone global segment. Key & Wall Solutions operates as a standalone self-contained segment with two global businesses – Key Systems and Movable Walls. It includes production facilities, which are situated in North and South America, Europe, and Asia. The original equipment manufacturing (OEM) business has plants in mainland China and Taiwan.

Operating model

Global Innovation is responsible for delivering customer- and market-oriented product and solution developments and innovations. In cooperation with the Global Commercial function it develops and steers innovations and technology strategies to foster dormakaba’s innovation leadership in the market.

Corporate Functions (Finance, HR, Legal, and IT) globally support the above business units and functions to steer the business, drive implementation of the current Shape4Growth strategy, and strengthen customer centricity of dormakaba.

Organizational structure

In accordance with the management organization, the reporting to Group management consists of the seven key markets, Key & Wall Solutions and OEM, and the Global Functions, as described above. Segment reporting is prepared in line with our management reporting up to the adjusted EBIT contribution. The reporting forms the basis for assessing performance and allocating resources. Financial transactions of Global Functions that are directly attributable or can be allocated on a reasonable basis to a specific segment are reported under the segment concerned. The financial performance of the key markets is measured at full value contribution to the performance of the Group to improve financial steering, transparency, and accountability. The segment results are based on the same accounting principles that are used to determine the operating profit of the Group. Intersegment transactions are based on the arm’s length principle.

Offering

dormakaba Group provides smart, secure, and sustainable solutions for seamless flow and integrated access. Its portfolio of strong brands offers customers the full range of products, solutions, and services for access to premises, buildings, and rooms. From award-winning, end-to-end access solutions to industry best practices and straightforward installation across a range of markets and industries, dormakaba is a complete partner for door and access systems, catering to a broad range of industries such as hotels, retail spaces, sporting venues, airports, hospitals, offices, utilities, and multi-housing, as well as in some selected residential markets.

With a clear portfolio segmentation, dormakaba focuses on its global core businesses Access Automation Solutions (door operators, sliding doors, and revolving doors), Access Control Solutions (connected devices and engineered solutions), Access Hardware Solutions (door closers, exit devices, and mechanical key systems) and Services. The Group is also a market leader for Key Systems (key blanks, key cutting machines, and automotive solutions such as transponder keys and programmers), as well as Movable Walls including acoustic movable partitions and horizontal and vertical partitioning systems.

Segment reporting

|

|

|

Access Solutions |

|

Key & Wall Solutions and OEM |

|

Corporate |

|

Eliminations |

|

Group |

||||||||||

|

CHF million |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Net sales third parties |

|

2,399.3 |

|

2,409.4 |

|

437.8 |

|

439.4 |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

|

2,837.1 |

|

2,848.8 |

|

Intercompany sales |

|

6.6 |

|

4.7 |

|

46.6 |

|

46.9 |

|

0.0 |

|

0.0 |

|

–53.2 |

|

–51.6 |

|

0.0 |

|

0.0 |

|

Total sales |

|

2,405.9 |

|

2,414.1 |

|

484.4 |

|

486.3 |

|

0.0 |

|

0.0 |

|

–53.2 |

|

–51.6 |

|

2,837.1 |

|

2,848.8 |

|

Adjusted EBIT (Adjusted operating profit) |

|

308.5 |

|

284.7 |

|

82.4 |

|

69.3 |

|

–46.9 |

|

–46.5 |

|

0.0 |

|

0.0 |

|

344.0 |

|

307.5 |

|

as % of sales |

|

12.8% |

|

11.8% |

|

17.0% |

|

14.3% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

12.1% |

|

10.8% |

|

Adjusted depreciation and amortization |

|

57.8 |

|

61.8 |

|

12.8 |

|

13.5 |

|

2.3 |

|

2.0 |

|

0.0 |

|

0.0 |

|

72.9 |

|

77.3 |

|

Adjusted EBITDA (Adjusted operating profit before depreciation and amortization) |

|

366.3 |

|

346.5 |

|

95.2 |

|

82.8 |

|

–44.6 |

|

–44.5 |

|

0.0 |

|

0.0 |

|

416.9 |

|

384.8 |

|

as % of sales |

|

15.2% |

|

14.4% |

|

19.7% |

|

17.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

14.7% |

|

13.5% |

|

Net working capital |

|

634.3 |

|

618.4 |

|

88.3 |

|

93.0 |

|

–18.3 |

|

–17.4 |

|

0.0 |

|

0.0 |

|

704.3 |

|

694.0 |

|

Capital expenditure |

|

70.2 |

|

62.9 |

|

13.7 |

|

11.9 |

|

18.0 |

|

23.7 |

|

0.0 |

|

0.0 |

|

101.9 |

|

98.5 |

|

Average number of full-time equivalent employees |

|

11,713 |

|

11,749 |

|

3,162 |

|

3,267 |

|

461 |

|

503 |

|

– |

|

– |

|

15,336 |

|

15,519 |

Reconciliation of operational figures

|

|

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

||||||||

|

CHF million |

|

Adjusted |

|

IAC 1 |

|

Unadjusted |

|

Adjusted |

|

IAC 1 |

|

Unadjusted |

|

Operating profit before depreciation and amortization (EBITDA) |

|

416.9 |

|

–123.8 |

|

293.1 |

|

384.8 |

|

–59.0 |

|

325.8 |

|

Depreciation and amortization |

|

–72.9 |

|

–55.2 |

|

–128.1 |

|

–77.3 |

|

–59.5 |

|

–136.8 |

|

Operating profit (EBIT) |

|

344.0 |

|

–179.0 |

|

165.0 |

|

307.5 |

|

–118.5 |

|

189.0 |

1 Content of items affecting comparability (IAC) is described in the note on alternative performance measures (APM) (5.2).

1.2 Net sales per geographical markets/business units

|

CHF million |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Net sales third parties |

|

|

|

|

|

USA/Canada |

|

712.1 |

|

717.8 |

|

Germany |

|

327.0 |

|

304.1 |

|

Australia/New Zealand |

|

200.7 |

|

212.8 |

|

Switzerland |

|

211.3 |

|

212.6 |

|

UK/Ireland |

|

111.4 |

|

111.9 |

|

Rest of the World |

|

836.8 |

|

850.2 |

|

Total Access Solutions |

|

2,399.3 |

|

2,409.4 |

|

Key & Wall Solutions and OEM |

|

437.8 |

|

439.4 |

|

Group |

|

2,837.1 |

|

2,848.8 |

1.3 Personnel expenses

|

CHF million |

|

|

Financial year ended 30.06.2024 |

% |

|

Financial year ended 30.06.2023 |

% |

|

Personnel expenses |

|

|

1,210.1 |

100.0 |

|

1,127.9 |

100.0 |

|

Salaries and wages |

|

|

912.1 |

75.4 |

|

905.5 |

80.3 |

|

Social security expenses |

|

|

176.6 |

14.6 |

|

170.4 |

15.1 |

|

Share-based payments |

|

|

5.7 |

0.5 |

|

7.1 |

0.6 |

|

Pension benefit expenses (see note 2.5) |

|

|

33.0 |

2.7 |

|

35.6 |

3.2 |

|

Employment termination expenses |

|

|

82.1 |

6.8 |

|

8.3 |

0.7 |

|

Other benefits |

|

|

0.6 |

0.0 |

|

1.0 |

0.1 |

|

Number of full-time equivalent employees |

|

|

Financial year ended 30.06.2024 |

% |

|

Financial year ended 30.06.2023 |

% |

|

Employees at balance sheet date |

|

|

15,444 |

|

|

15,352 |

|

|

Average number of employees per functions and business units |

|

|

15,336 |

100.0 |

|

15,519 |

100.0 |

|

Total Access Solutions |

|

|

11,713 |

76.4 |

|

11,749 |

75.7 |

|

Commercial and Marketing |

|

|

7,185 |

46.8 |

|

7,319 |

47.2 |

|

Operations |

|

|

3,098 |

20.2 |

|

3,013 |

19.4 |

|

Innovation |

|

|

744 |

4.9 |

|

747 |

4.8 |

|

Finance and HR |

|

|

686 |

4.5 |

|

670 |

4.3 |

|

Key & Wall Solutions and OEM |

|

|

3,162 |

20.6 |

|

3,267 |

21.1 |

|

Corporate |

|

|

461 |

3.0 |

|

503 |

3.2 |

|

Average number of employees per geographical region |

|

|

15,336 |

100.0 |

|

15,519 |

100.0 |

|

Switzerland |

|

|

913 |

6.0 |

|

932 |

6.0 |

|

Germany |

|

|

2,787 |

18.2 |

|

2,788 |

18.0 |

|

Rest of EMEA |

|

|

3,979 |

25.9 |

|

4,018 |

25.9 |

|

Americas |

|

|

3,480 |

22.7 |

|

3,462 |

22.3 |

|

Asia Pacific |

|

|

4,177 |

27.2 |

|

4,319 |

27.8 |

Share-based payments

The Nomination and Compensation Committee is responsible for nominating individual members of the Executive Committee (EC) and other Senior Management members for long-term incentive (LTI) awards. The LTI award is granted through a Performance Share Unit (PSU) plan, vesting over three years and subject to the achievement of performance conditions. During the reporting period, the LTI grants include performance indicators such as relative Total Shareholder Return (TSR), Earnings per Share (EPS), and Sustainability (ESG) related targets. ESG targets have been introduced as from the grant 2023 to reflect the increasing importance of sustainability and cover both social and environmental topics that are addressed by our sustainability strategy. The vesting level may range from 0% to a maximum of 200% of the original number of units granted (maximum two shares for each performance share unit originally granted); there is no vesting below the threshold levels of performance.

The fair value of the Performance Share Units (PSUs) at the grant date includes adjustments for foregone dividends during the vesting period and the Total Shareholder Return (TSR) performance condition. The associated expenses are recognized on a straight-line basis over the vesting period. The restricted shares allocated to the members of the Board of Directors (BoD) are blocked for three years.

The fair value of the restricted shares corresponds to the value of the closing price of the dormakaba Holding AG share on the SIX Swiss Exchange as at the business day prior to the date of the allocation.

Further information about the allocation of treasury shares is disclosed in the note on share capital and treasury shares (3.2), and further details about long-term incentive stock award plans are outlined in the Compensation Report.

1.4 Other operating expenses

|

CHF million |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Total other operating expenses |

|

–55.0 |

|

–62.1 |

|

Goodwill amortization |

|

–49.5 |

|

–59.5 |

|

Loss from sale of subsidiaries |

|

–3.6 |

|

0.0 |

|

Other operating expenses |

|

–1.9 |

|

–2.6 |

1.5 Financial result

|

CHF million |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

|

Financial income |

|

|

2.5 |

|

1.5 |

|

Interest income |

|

|

2.4 |

|

1.4 |

|

Other financial income |

|

|

0.1 |

|

0.1 |

|

Financial expense |

|

|

45.0 |

|

48.9 |

|

Interest expenses for bonds |

|

13.6 |

|

10.6 |

|

|

Interest expenses for forward contracts |

|

12.5 |

|

14.4 |

|

|

Other interest expenses |

|

|

11.2 |

|

16.5 |

|

Foreign exchange losses (gains) |

|

2.6 |

|

4.3 |

|

|

Other financial expenses |

|

|

5.1 |

|

3.1 |

1.6 Taxes

Income taxes

The weighted applicable tax rate results from applying each subsidiary’s statutory income tax rate to the income before taxes. Since the Group operates in countries that have different tax rates, the weighted applicable tax rate may vary from year to year according to variations in income per country and changes in applicable tax rates.

|

CHF million |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Profit before taxes |

|

134.1 |

|

142.2 |

|

Weighted applicable tax rate |

|

22.9% |

|

24.8% |

|

Tax calculated at applicable tax rate |

|

30.7 |

|

35.3 |

|

Current income taxes |

|

55.4 |

|

48.7 |

|

Deferred income taxes |

|

–3.5 |

|

5.0 |

|

Income taxes |

|

51.9 |

|

53.7 |

|

Difference between applicable and effective income taxes |

|

21.2 |

|

18.4 |

|

Impact of losses and tax loss carryforwards |

|

9.7 |

|

–3.3 |

|

Tax-exempt income |

|

–2.8 |

|

–3.8 |

|

Non-deductible expenses |

|

7.1 |

|

6.3 |

|

Non-taxable/non-deductible divestments/goodwill amortization |

|

9.5 |

|

14.8 |

|

Non-recoverable withholding tax expenses |

|

6.0 |

|

3.4 |

|

Effect of change in tax rates |

|

–0.1 |

|

2.2 |

|

Tax charges (credits) relating to prior periods, net |

|

–2.3 |

|

–0.3 |

|

Other |

|

–5.9 |

|

–0.9 |

|

Income taxes charged to equity |

|

1.4 |

|

–0.7 |

The effective income tax rate of 38.7% (2022/23: 37.8%) is impacted by divestments and the amortization of goodwill. The amortization of goodwill, which is non-deductible for tax purposes, leads to an increase of the effective tax rate, whereas the profit from the sale of investments, being non-taxable, reduces the effective tax rate. This impact is disclosed separately in the reconciliation above (divestments/non-deductible goodwill amortization). Without this impact, the effective tax rate is 29.3% (2022/23: 26.6%).

In 2023/24, the tax rate was further affected by tax losses resulting from restructuring costs. Consistent with our accounting policy, no tax benefit has been recognized for these losses. Excluding this negative impact of CHF 8.8 million, the tax rate would have been 24.5% (2022/23: 26.6%). A corresponding tax benefit can be anticipated in future years when the tax losses are utilized.

The variance in “Other” compared to the previous year is attributed to a change in tax provisions.

Deferred taxes

|

CHF million |

|

Financial year ended 30.06.2024 |

|

Financial year ended 30.06.2023 |

|

Balance sheet presentation of deferred income taxes |

|

|

|

|

|

Total deferred income taxes, net |

|

115.2 |

|

112.0 |

|

Deferred income tax assets |

|

137.1 |

|

143.0 |

|

Deferred income tax liabilities |

|

21.9 |

|

31.0 |

|

Expiration of tax loss carryforwards not recognized as deferred tax assets |

|

|

|

|

|

Balance of tax loss carryforwards at end of financial year |

|

147.9 |

|

122.4 |

|

Expiry in 1 year |

|

5.8 |

|

2.1 |

|

Expiry in 2 to 5 years |

|

12.1 |

|

16.1 |

|

Expiry after 5 years |

|

9.9 |

|

8.5 |

|

No expiry |

|

120.1 |

|

95.7 |

The unrecognized tax loss carryforwards of CHF 147.9 million (2022/23: CHF 122.4 million) have the potential to generate tax relief of CHF 36.0 million (previous year: CHF 28.1 million). The increase of CHF 25.5 million in unrecognized tax loss carryforwards is primarily attributable to restructuring costs, which led to tax losses in some jurisdictions. Over the medium term, it is anticipated that up to CHF 10.4 million (2022/23: CHF 2.7 million) of the CHF 36.0 million potential tax relief may be realized.

In December 2021, the OECD published the Pillar Two model rules to introduce a global minimum corporate income tax of 15% for multinational companies with consolidated sales of more than EUR 750 million. Meanwhile, Pillar Two legislation has been enacted or substantially enacted in many jurisdictions in which dormakaba operates. The legislation will be effective for dormakaba’s financial year beginning 1 July 2024. dormakaba performed an assessment of the potential exposure to Pillar Two income taxes. The application of the Pillar Two model rules would not have had a material impact on the financial results of 2023/24. dormakaba continues to monitor the development of the Pillar Two model rules and continually assesses the impact thereof on dormakaba.